Navigating Commercial Real Estate in a Cooling Market: Strategies for Success

Seeing Signs? Rising vacancy rates, higher concessions, slower rent growth, longer lease negotiations, and increasing sublease space. Discover essential strategies for navigating a softening commercial real estate market.

Retail Space in Austin - Low Retail Vacancy & High Demand

Times are surely changing and there’s no place like Austin for retail. Driving across America, you may likely find some vacant retail strips or ghost towns with empty stores but definitely not in Austin! Austin is just the opposite of a typical US city, with a surprisingly lower retail vacancy since 2020. The capital of Texas now has the lowest retail vacancy rate for any city in the State of Texas and is also one of the lowest in the country. Competition is fierce in major Retail Areas such as the Domain and other trendy shopping streets like South Congress, 2nd street Downtown, Burnet Rd, and East Austin. Properties command high rent and spaces have multiple businesses looking at each sight and competing with each other to be selected by the Landlord.

New East Austin Development 2023- Beck-Reit with DC+A , Swinerton and FORT Structures

DeLea Becker and Mark Vornberg met for the first time in 2017 for lunch at an old-school dinner in East Austin - Chu-Mikals. Excited to announce our first Partnership in a Commercial Real Estate Development together. 2422 East 7th - 50,000 SF Office and Retail Building in their beloved neighborhood - East Austin

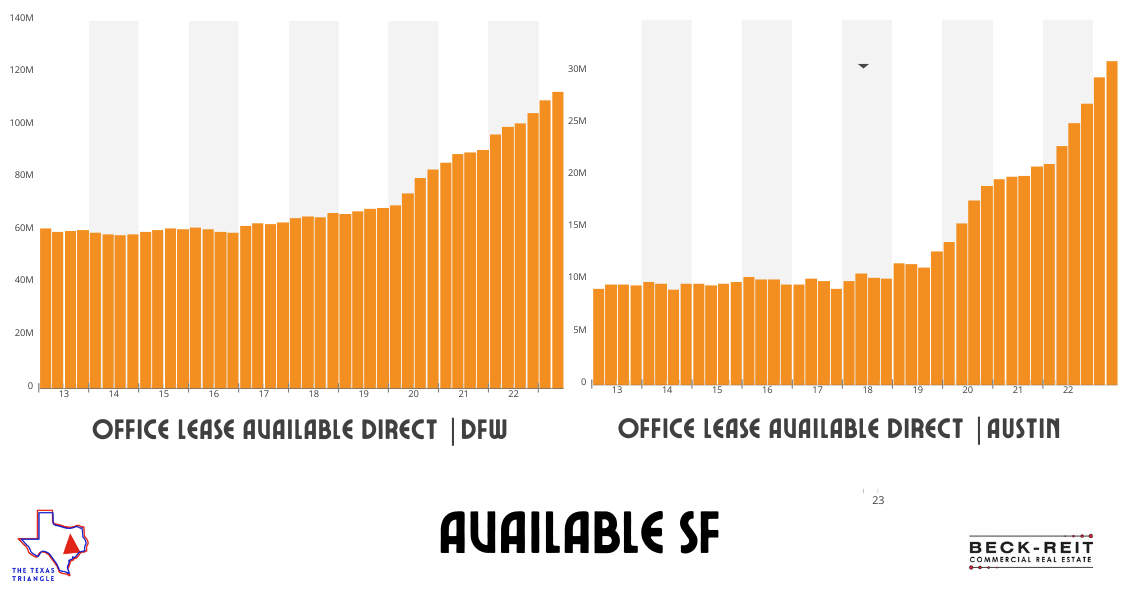

Office Vacancy in the Texas Triangle

"Unlocking the Future of Texas Office Spaces: Where Innovation Meets Real Estate Revolution! 🚀 Dive into our latest blog post as we unveil the seismic shifts reshaping the commercial real estate horizon across the Lone Star State. From sky-high vacancy rates to ingenious strategies that redefine leasing dynamics, this article is your gateway to navigating the winds of change. Get ready to explore pickleball-powered spaces, 'hall select' customization and the art of crafting workplaces that inspire. If you're captivated by the fusion of innovation and real estate, this read is your compass to the future. 🏢

Mann Report : Bringing Women Owners into CRE featuring DeLea Becker

The Mann Report publication wrote an inspiring article geared towards to importance of bringing owners into CRE. It’s no surprise that Beck-Reit’s own DeLea Becker was top of mind on this topic, as bringing more women into Commercial Real Estate is probably her favorite passion project.

Austin Women Trailblazers

Bisnow is honoring Austin’s most influential trailblazers - Top-level women executives and industry powerhouses who influence the way commercial real estate is done in ATX. Read the article full of quotes by our Founder DeLea Becker : “Building The Plane While Flying It”: Women In Austin CRE Are Soaring

Beck-Reit is seeking 1031 Exchange Property up to $1 Million

Searching in San Antonio, Austin, DFW, Houston and everywhere in between - #TexasTriangle

Looking for up to $1 million

Office / Industrial / Retail

Please send over any and all options! delea@beckreit.com & office@beckreit.com

3110 S Lamar ATX 78704

3110 S. Lamar Austin, TX 78704 is now a part of Beck-Reit Commercial Real Estate’s portfolio. Secured in a 1031 Exchange | Off-Market Deal. This Advanced Autoparts is situated on one of the most desirable streets in Austin. The current lease gives time for entitlement and development plans (3 year + process in Austin) so we will be poised with the Demolition Permit the day the lease ends.

Less than 3% of Commercial Real Estate is Owned and Managed by Women

According to research by BiggerPockets, women represent less than 2% of commercial real estate investors. This figure is surprising given that more women own and manage their own businesses today than ever before. Commercial real estate is an asset class that offers tremendous potential for growth, especially when you consider the current market conditions. However, most women are not investing in commercial real estate for one main reason: lack of knowledge about how it works and how they can get started investing. But this isn't true for Women In Commercial Real Estate. For Women in our profession, investing is squarely in our Circle of Competence.

There is potential to create $1 trillion dollars of value for women in commercial real estate by 2025 if we start investing like men. It's a $3.5 trillion dollar industry, and it's the largest one in the world.

1031 Diary II: Boost Mobile, 4403 W. Commerce

We acquired 4403 W Commerce in December of 2020 after selling 2707 Rogge Lane. The Rogge property was an East Side shopping center near the Mueller that required a gut renovation. We had it leased up and were working through our redevelopment plans when Austin’s growth out-paced us and a bigger fish came with an offer we couldn’t refuse.

Similar to our 8808 Barker Cypress acquisition, we felt like we could sell high in the Austin market and move our gains into a safe and stable NNN investment elsewhere.

Beck-Reit is BUYING! Send Us Your Listings!

Feasibility is about to expire on the sale of our fully-leased, 20,000sqft Warehouse in Creedmoor, TX, which means we've got nearly $2M cash to place in a safe NNN investment.

We're willing to go up to $4M for the right property... send us a winner and we'll show you the money!!

Purchase Requirement:

NNN Lease, Long Term Lease (5 year +)

Strong Tenant (Community Oriented, Recession Proof Industry, Solid FInancials

New Construction (2015-Present)

Austin/San Antonio/Dallas/Houston Location

Read our latest BLOG POST to get the full scoop on our risky warehouse play, how we turned the opportunity into a BIG SUCCESS, and how we plan to #protectthegain given our history of 1031 Exchanges.

A Look Back in Time | 6 months into 2022

See Below for an Overview of the last 6-months at Beck-Reit Commercial Real Estate, and Scroll to the Bottom for DeLea’s Notes and Takeaways from Rednews' Recent AUSTIN RETAIL FORECAST PANEL

REDNews | 3rd Annual Austin CRE Forecast 2022

This is not DeLea’s first rodeo, she has sat on the Red News Forecast Retail panel before. This is her 3-peat performance and the 1st time was the day before the pandemic shut down the world and she recalls an uncommon prediction that was in line with the outcome. Read about it in her blog below. You won’t want to miss DeLea talk about retail numbers, strategies, adaptive reuse, e-commerce impact, and trend analysis predictions.

Our old office building will be raised to make way 800 unit multi-family complex!

Beck-Reit’s Previous Office Will Be Razed for Mixed-Use Development

Beck-Reit & Sons Construction performed a gut renovation at 2131 Theo between 2014-2016, an adaptive reuse project that turned the aging auto repair shop into a 5-unit creative office space with shared conference room, kitchen, and lobby. The finished project was managed by Beck-Reit Asset Management and leased by Beck-Reit Commercial Real Estate until 2020, when the developers came knocking with an offer we couldn’t refuse.