Lower Rates, Weaker Dollars, Smarter Moves

When the Fed Prints, Assets Win and Debt Structure Becomes the Edge

Money is getting easier again.

Interest rates are coming down.

Liquidity is expanding.

And the dollar is quietly losing purchasing power — the way it always does when more of it gets created.

This isn’t drama.

It’s how the system works.

What Just Changed

Starting Friday, 12.12.25, the Federal Reserve resumed daily liquidity injections — roughly $43 million per day entering the financial system through various programs.

This isn’t about headlines.

It’s about mechanics.

When the Fed prints, dollars multiply.

When dollars multiply, each one buys a little less.

Why Lower Interest Rates Matter

Lower rates aren’t designed to help consumers.

They exist to:

Reduce pressure on debt

Encourage borrowing

Support asset values

For operators who understand leverage, this is not a warning sign.

It’s a window.

Cheaper money changes behavior — and it rewards people who own assets financed with long-term, fixed debt.

Cash Feels Safe — Until It Isn’t

Cash doesn’t fluctuate, which makes people comfortable.

But in periods of monetary expansion, cash is the only asset guaranteed to lose value in real terms.

You don’t see it immediately.

You feel it later — in higher costs, higher rents, higher replacement prices.

Comfort is expensive.

Why Cash Underperforms in This Cycle

Cash feels stable, but in an expanding money supply:

Purchasing power erodes

Prices adjust upward

Holding cash becomes a hidden cost

Stability is not the same as preservation.

Why Assets Hold Up Better

Real assets adjust with inflation:

Replacement costs rise

Values recalibrate

Income potential increases

Debt stays fixed.

Assets move.

That spread is the advantage.

Why Loan Structure Matters More Than Rate

Most people focus on interest rate.

Experienced operators focus on structure.

Small changes in amortization dramatically change monthly obligations — even when rates are nearly identical.

Same asset. Same price. Different cash position.

This Is Where Financing Strategy Comes In

This is exactly why banks that understand owner-occupied businesses are stepping up right now.

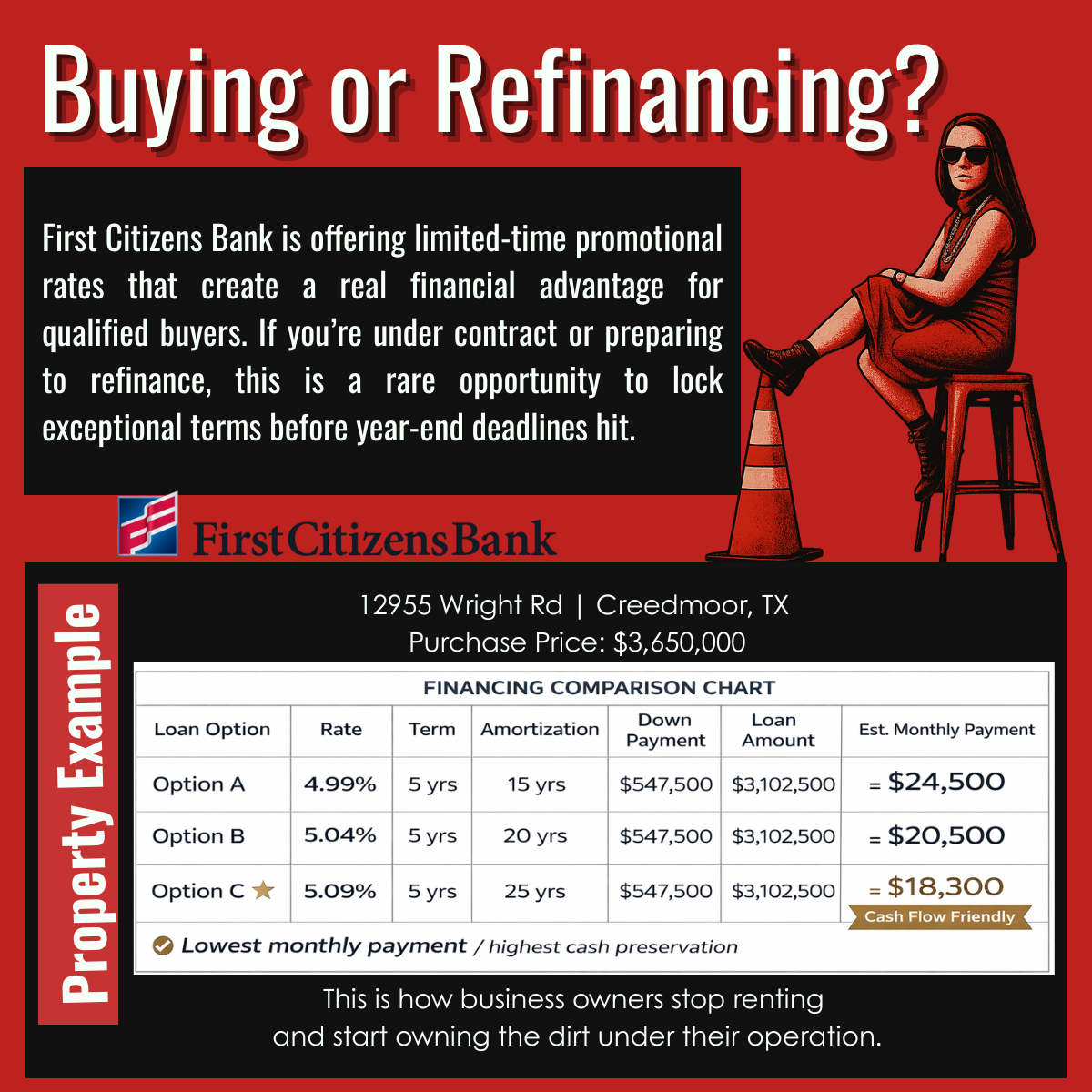

First Citizens has rolled out a targeted owner-occupied financing structure designed to give borrowers flexibility in a changing rate environment — without chasing teaser rates or risky terms.

Instead of one rigid loan, they’re offering three structured amortization paths under the same program.

The First Citizens Owner-Occupied Special

Under this First Citizens structure, borrowers choose how aggressive or conservative they want to be — while staying in the same rate environment.

Assumptions:

Owner-occupied (51%+)

5-year fixed term

~15% down

Option 1 — 15-Year Amortization

Approx. 4.99%

Higher monthly payment

Faster equity build

Best for:

Strong cash flow, balance-sheet driven operators.

Option 2 — 20-Year Amortization

Approx. 5.04%

Balanced payment structure

Steady equity growth

Best for:

Operators who want predictability without constraining operations.

Option 3 — 25-Year Amortization

Approx. 5.09%

Lowest monthly payment

Maximum cash preservation

Best for:

Growth-focused businesses prioritizing flexibility and control.

Same loan program.

Same lender.

Very different cash outcomes.

How This Plays Out in the Real World

When applied to real owner-occupied properties — like 12955 Wright Rd in Creedmoor, Texas — the difference between these options can mean thousands of dollars per month in operating cash.

That cash difference impacts:

Hiring

Equipment

Growth

Stability

This is why structure matters more than rate.

Bottom Line

When:

Rates soften

Liquidity expands

The dollar weakens over time

Assets tend to outperform cash — especially when paired with smart, flexible debt.

The First Citizens owner-occupied structure is a clear example of how lenders and borrowers can align in this phase of the cycle.

This isn’t about timing the market.

It’s about positioning correctly when the rules of money shift.

REAL-WORLD EXAMPLES — PROPERTIES CURRENTLY AVAILABLE

Understanding money cycles and loan structure matters — but execution still happens at the property level.

These are two owner-user–friendly assets currently available that align well with today’s financing environment.

12955 Wright Rd | Creedmoor, TX

Owner-User Industrial / Flex Opportunity

This property is a strong example of how owner-occupied financing can be applied in the real world.

Why it works:

Built for operational businesses

SBA-eligible (owner-occupied)

Flexible loan structures available (Conventional, SBA 7(a), SBA 504)

Opportunity to control long-term occupancy and costs

This asset illustrates how loan structure — not just interest rate — changes the economics of ownership.

4403 W Commerce St | San Antonio, TX

Owner-User / Investment Commercial Property

This property offers flexibility for:

Owner-users

Hybrid owner-user / investment reminders

Businesses looking for long-term positioning in an urban corridor

Why it matters:

Strong location fundamentals

Adaptable use profile

Opportunity to combine operations with future upside

This is the type of asset that performs well when capital gets cheaper and replacement costs continue to rise.