12955 Wright Rd , Creedmore, Texas 78601

FOR LEASE

$10.50/SF + NNN

NNN Estimate 2025 = $5.52

FOR SALE + FOR LEASE

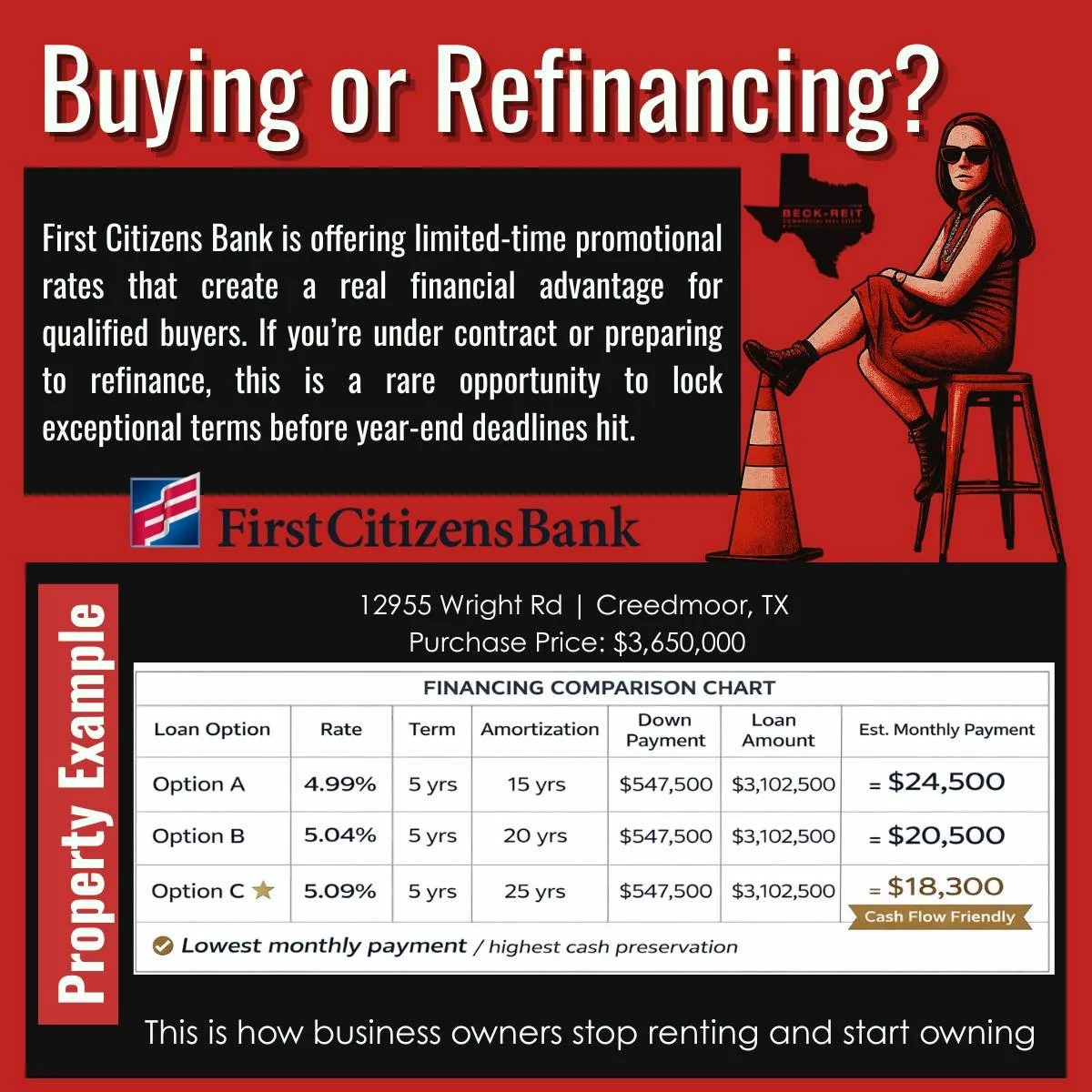

FOR SALE

$3.65 Million

20,000 SF warehouse with 1500 SF office space located in the Austin, TX Southeast Industrial Submarket NOW AVAILABLE for lease.

3-5 Year Lease

Owner WILL SELL

Contact DeLea Becker for More Info

delea@beckreit.com

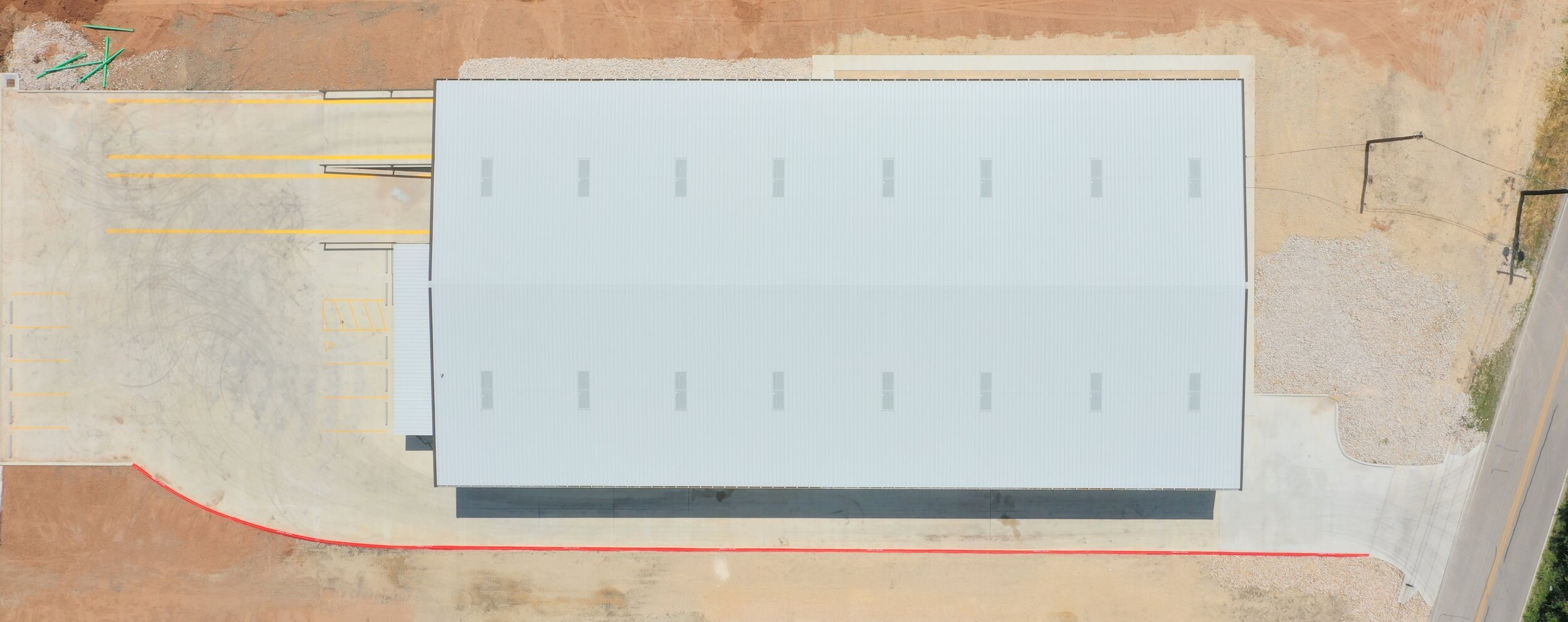

The building has grade-level and dock-high overhead doors and sits on a 1.8 acre site. The property has easy access off Wright Road, and has SH-45 visibility. With close proximity to IH-35 and SH-45, this location makes it easy to get anywhere in the Austin, Texas metro area. Please contact broker for additional details.

20,000 SF

Grade-level and Dock-high loading (16 ft. height) 18-22' clear height

3-phase, 400 amp electric service

Fully Insulated

Skylights Throughout for Natural Light

1,500 SF HVAC office - 3 private offices with 2 restrooms

Close proximity to Formula 1, TESLA and Austin Airport (ABIA

ETJ

SEPTIC

WATER - CREEDMORE-MAHA

12955 Wright Road - Exterior

12955 Wright Rd - 1,500sqft Office

12955 Wright Rd - WAREHOUSE

Austin & Central Texas Industrial Insights (Beck‑Reit Resource Hub)

Industrial real estate decisions aren’t made on vacancy charts alone. Beck‑Reit publishes strategic, narrative, and infrastructure-driven insights across Austin and Central Texas—focused on the real-world drivers that shape industrial demand: highways, utilities, redevelopment, and timing. Explore the resources below to understand the “why” behind the location.

-

Austin’s Commercial Real Estate Trajectory (2025 market insights)

Boots-on-the-ground perspective on Austin’s evolving market and what it means for operators and owners. -

I‑35 Expansion in Austin: timeline, maps, and real estate impact

Infrastructure changes drive route reliability—one of the most overlooked factors in industrial site selection. -

Central Texas Industrial Redevelopment: Sandow Lakes Ranch (developer’s perspective)

A deep dive into why infrastructure-rich locations become magnets for advanced manufacturing and logistics. -

Navigating a Cooling CRE Market: strategies for investors & landlords

How to think clearly when the market shifts: pricing, terms, cash flow, and operational focus. -

The Power Behind AI: energy demands, utilities, and real estate opportunities

Why power, water, and utility infrastructure increasingly shape where “next-generation” industrial land and buildings work. -

East Austin Development Map (projects + infrastructure)

A visual tool for tracking the growth patterns that influence leasing, pricing, and long-term value. -

Industrial Parks & Logistics Insights (browse the category)

Ongoing posts on industrial parks, logistics, and redevelopment across Texas. -

The Beck‑Reit Briefing (all market insights)

Browse all articles, updates, and trend commentary across Austin and beyond.

Industrial Real Estate FAQ (Austin / Central Texas)

These are the real questions owners, operators, and executives ask when deciding whether to lease or buy an industrial building in Central Texas. The answers below are written to help you evaluate operational fit, true cost, and risk—before you ever tour a property.

1) Should we lease or buy an industrial building in Austin right now?

Leasing usually wins when you need flexibility (growth uncertainty, seasonal swings, short project timelines, or you’re still testing a new market). Buying often wins when your footprint is stable and you want long-term cost control, customization, and balance-sheet stability through ownership.

A practical way executives decide: compare total occupancy cost (lease) versus ownership cash flow (mortgage + operating costs + reserves) and then apply your company’s reality: how fast you’re growing, how important location control is, and whether you’d rather keep capital in the business.

Related reading: Strategies for operating in a cooling CRE market

2) What is NNN and how do I estimate my true monthly lease cost?

Most industrial leases quote a base rent and then add NNN expenses (often property taxes, insurance, and property/common-area operating costs). The real number leaders budget is:

- Base rent + NNN (or CAM/taxes/insurance)

- Utilities (electric, water, gas, waste)

- Repairs/maintenance responsibilities (depends on the lease)

- Tenant improvements (TI), racking, equipment, moving, signage

Ask for a clean “all‑in occupancy” estimate so your team compares options apples-to-apples.

3) Do we need dock-high loading, grade-level loading, or both?

It depends on how your operation moves product and equipment:

- Dock-high is typically best for pallets, freight, and regular carrier shipments.

- Grade-level is usually best for service fleets, contractors, equipment roll-in/roll-out, and flexible access.

- Both gives you the widest operational flexibility and helps future-proof the building for different uses.

If you’re running a mixed operation (service + shipping/receiving), having both loading styles can be a meaningful advantage.

4) How much clear height do we need—and what does it change?

Clear height affects storage density, racking design, forklift type, and long-term flexibility. If your business uses pallet racking, tall equipment, or wants to maximize cubic storage, clear height matters a lot. If your business is more “service industrial” (trades, light assembly, fleet-based operations), you may not need extreme clear height to run efficiently.

A helpful question to ask your ops lead: “What racking height do we actually plan to use in year 1—and what would we want in year 3?” That answer usually tells you the minimum clear height you should accept.

5) What does 3‑phase power mean—and do we need it?

3‑phase electrical service is often essential for equipment-heavy users: fabrication, compressors, lifts, packaging lines, CNC equipment, and many light manufacturing workflows. If you’re adding machinery, charging infrastructure, or specialized equipment, power capacity becomes a real constraint.

Upgrading electrical service later can be expensive and slow, so many operators prioritize buildings that already support serious power needs.

Related reading: Why power & utility infrastructure matter more than ever

6) What makes a warehouse location “good” in Austin for operations and hiring?

Industrial location decisions usually come down to three realities:

- Route reliability: predictable travel times for trucks, vans, and field crews (not just “distance”).

- Labor access: how far your team can commute without constant churn.

- Customer reach: ability to serve multiple parts of the metro quickly.

In Austin, infrastructure projects and growth patterns can change travel times and demand nodes over time—so it’s smart to understand the corridor dynamics, not just the address.

Related resources: I‑35 Expansion guide | East Austin Development Map | Central Texas industrial redevelopment case study

7) What diligence should we do before signing a lease (or buying)?

Strong operators treat industrial real estate like operational infrastructure. Before committing, most teams verify:

- Use & zoning: confirm your use is permitted (and whether outdoor storage is allowed).

- Fire/sprinkler: code compliance for your inventory type and operations.

- Power: confirm service type, amperage, and panel capacity for current + future equipment.

- Roof & building condition: especially if storing sensitive materials or running production.

- Truck access: turning radii, parking, delivery hours, and circulation.

- Lease language: repair responsibilities, renewal options, expansion rights, and assignment/sublease flexibility.

If you want a market-level mindset for navigating shifting conditions (pricing, terms, tenant leverage), this is a useful primer: Cooling market strategies

8)What is the full “all‑in” monthly rent for this building?

The current all‑in estimated monthly rent is $26,700 per month.

This is based on:

- Base Rent: $10.50 per SF × 20,000 SF = $210,000 annually

- NNN Estimate (2025): $5.52 per SF × 20,000 SF = $110,400 annually

Total Annual Occupancy Cost: $320,400

Total Monthly Cost: $26,700

The base rent increases by 3% annually. NNN expenses are estimates and may adjust year to year based on actual operating costs, taxes, and insurance.

Most tenants and owner‑operators use this “all‑in” number to budget cash flow and compare lease versus ownership scenarios.

More industrial and infrastructure insights: Industrial Parks & Logistics | Beck‑Reit Resource Hub