East Coffee Investing with friends

Welcome to the expansive and intricate world of commercial real estate investment. As detailed in our robust conversation at the East Austin Coffee meetup, we delved into the crucial considerations and strategies essential for entering and succeeding in this dynamic market. Guided by DeLea Becker, owner of Beck-Reit Commercial Real Estate, alongside industry professionals Stephanie Pierce, Bill Hamilton, and Guy Dudley, we explored the multifaceted journey of real estate partnerships and investments. Here is a comprehensive overview of our discussion:

The Importance of Industry Friends and Knowledge

The first and perhaps most crucial point made is about the importance of partnering with knowledgeable industry friends. DeLea Becker emphasizes selecting partners with a genuine understanding of commercial real estate, crucial for navigating its complexities compared to residential real estate or stock market investments.

Choosing the Right Investment Partners

When selecting partners, financial credibility and mutual trust are paramount. DeLea specifically highlights the importance of being "evenly yoked" to ensure both parties have the means and willingness to weather financial fluctuations and challenges. Furthermore, understanding each partner's strengths, such as financial acumen or architectural expertise, can significantly enhance investment success.

Understanding Investment Mechanics

1. Type of Property: From DeLea's perspective, investing in office, retail, warehouse, and land is often more beneficial than multifamily properties, which come with additional regulatory challenges.

2. Location: Investing within a specific geographic radius where one can quickly respond to any issues is crucial. Familiarity with local laws and market conditions can also be a significant advantage.

3. Search for Properties: While platforms like CoStar, LoopNet, and Crexie provide accessibility, real value often comes from "bird dogging" — actively networking and pursuing off-market deals through strategic connections.

4. Valuation and Cash Flow: Understanding the tools for property valuation, like cap rate analysis, and knowing the potential for future development or improved cash flow are vital components in assessing property potential.

5. Tax Considerations: Bill Hamilton provides insights into tax strategies, like utilizing cost segregation studies to accelerate depreciation deductions for tax advantages.

The Importance of Industry Expertise and Familiarity

Students of the industry like Guy Dudley suggest that understanding each partner's expectations and roles is crucial. Lack of clarity can lead to disaster when acquaintances and friends join forces without clear communication and understanding. DeLea solidifies this idea by sharing her preference for investments close to home—drivable within a day—not only for convenience but also for the peace of mind of being able to handle unforeseen circumstances directly.

Location: A Key Factor in Real Estate Investment

DeLea offers her perspective on selecting investment locations, opting for areas within Texas due to familiarity with state laws and taxes. Bill Hamilton provides a CPA’s insight into the advantages of investing in states like Texas which have no income tax. He advises that each state has unique challenges and requirements, and understanding the locale is vital.

Searching for Properties and Evaluating Their Worth

The conversation moves to the tactical approach of finding properties, from using general platforms like LoopNet and Crexie to active “bird dogging” through networking and direct engagement. Determining a property's value involves assessing potential returns against factors like cap rates and future development opportunities. DeLea mentions that although some methods seem easy, leveraging harder, more strategic methods often yield richer outcomes.

Understanding Partnership Dynamics and Legal Structures

Investing with partners requires careful construction of legal agreements. DeLea advocates for creating LLCs individually for each property to safeguard assets and interests. Also, reading and understanding contracts thoroughly can’t be overstressed as each party must be aware of its impact. Bill Hamilton concurs, suggesting that LLCs pose fewer complications than S Corps in terms of tax arrangements.

Syndications vs. Partnerships

Understanding the dynamics of general and limited partner roles is essential, especially in syndications. As Guy Dudley elaborates, clarity in roles and expectations can avert conflicts and ensure smooth operations. The decision-making process should be enshrined in the partnership or company agreement, detailing responsibilities, financial arrangements, and exit strategies.

Ongoing Management and Exit Strategies

Once invested, the effective management of the property becomes a critical focus area. As noted, this includes having reserves for unexpected expenses and maintaining clear communication regarding responsibilities and decisions. Additionally, preparing for potential exits or buyouts well in advance through detailed company agreements helps alleviate future conflicts.

Adding Value to Properties

Determining when to enhance or redevelop a property often depends on market conditions and strategic tenant opportunities. Knowing when to reinvest in a property can significantly increase its value and profitability.

Combining Knowledge, Strategy, and Trust

Commercial real estate investment is about diverse partnerships, strategic financial planning, and the creative potential to unlock long-term value. Whether it's an expert CPA bringing insights on tax optimization, or an experienced architect providing innovative design solutions, the synergy between partners can transform potential challenges into opportunities.

The panel discussion reveals the multifaceted nature of commercial real estate investing. Whether you're diving deeply into detailed cost segregation studies for tax benefits or strategically choosing investment locations, successful endeavors require knowledge, strategy, and trust. For investors like DeLea, the rewarding journey involves careful planning, an unwavering understanding of market dynamics, and a touch of entrepreneurial spirit.

This discussion offers just a glimpse into the complex world of commercial real estate investment. Whether you're a seasoned investor or just starting, the insights shared by these industry veterans can guide you toward building a fruitful portfolio.

Finally, remember, as DeLea succinctly puts it, "It's all about the money."

But at its core, investing in commercial real estate should also be about learning, legacy, and leaving a lasting impact beyond financial gain. Thank you for joining us on this journey through commercial real estate investment insights.

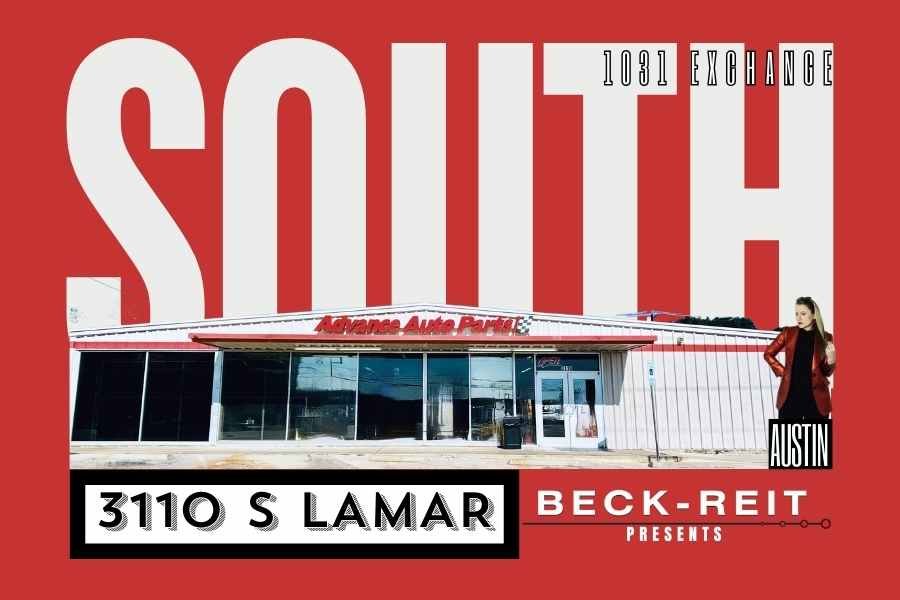

Properties We Own With Partners

FULL TRANSCRIPT

East Coffee Investing with friends

Join DeLea Becker, founder of Beck-Reit Commercial Real Estate, and her guests Stephanie Pierce, Bill Hamilton, and Guy Dudley as they dive deep into the world of commercial real estate investment. This episode provides invaluable insights on choosing investment partners, key questions to ask, understanding cap rates, syndication, and the importance of due diligence. The panel also covers strategies for finding lucrative properties, the benefits of cost segregation studies, and the critical legal documents needed for successful partnerships. Whether you're a seasoned investor or new to the field, this discussion offers practical advice and expert perspectives on navigating the commercial real estate market.

00:00 Introduction and Today's Topic

00:50 Meet the Panelists

03:04 Investing with Industry Friends

05:23 Choosing the Right Property

08:40 Location Considerations

13:32 Syndication Insights

16:27 Finding and Evaluating Properties

29:36 Legal and Financial Structures

41:13 Navigating Financial Obligations with Partners

42:32 The Importance of Choosing the Right Partner

43:24 Understanding Company Agreements and Interest Rates

44:18 Financial Realities and Partner Selection

46:07 Syndication Responsibilities and Agreements

47:32 Equity Distribution and Legal Considerations

48:57 Preferred Returns and Syndication Strategies

52:12 The Role of General and Limited Partners

54:50 Strategic Partner Selection and Long-Term Planning

01:11:25 Handling Exits and Unexpected Changes

01:15:36 Final Thoughts and Legacy Planning

DELEA BECKER: So good morning, everybody. Welcome to the East Austin Coffee. We have a topic today, which is Investing in Commercial Real Estate with Industry Friends. Specific to industry friends and when we go through our questions of, "Who you should invest with? What questions you should ask? How does it look what are some pitfalls and things to avoid?

DeLea Becker: You will understand that I specifically do select people that are in the commercial real estate industry. So that they have awareness at least of a lot of the things that go into commercial real estate And what makes it different from residential real estate or investing in the stock market?

DeLea Becker: So my name is DeLea Becker.

DeLea Becker: I am owner and founder of Beck-Reit Commercial Real Estate, Beck-Reit Asset Management, and an affiliate company, Beck-Reit and Sons Construction Company that does TXDOT Road and Bridge Repair. Now, joining me this morning, this has been a conversation in the works for a year or more. I have Stephanie Pierce.

DeLea Becker: I'll let you introduce yourself.

Stephanie Pierce: Hello, so I'm Stephanie, and as DeLea mentioned, we have been talking about this for a while, and, a little bit about me, so I do have a residential property, in Jarrell, and then I also have a commercial property in downtown Round Rock that I have a partner on, and then, yes, DeLea and I have been discussing potentially buying a building together, And this came out of what would that possibly look like and all the questions that other people might have also when going into a partnership with somebody.

DeLea Becker: Wait, what is your day job? What do you do?

Stephanie Pierce: Oh yes, sorry. We, I'm a part owner in an Architecture and Interior Design Firm, so we're a Spencer Pierce Architecture and Interiors, commercial, we don't do residential, in tenant finish outs and a little of everything,

DeLea Becker: austin only?

Stephanie Pierce: Central Texas.

Stephanie Pierce: We do have property, or we do have projects in Louisiana and Nebraska, but that was only for one client. We don't normally go that far. But yeah, we're in central Texas, mostly within a couple of hours of, around Ocran Falls.

Stephanie Pierce: Okay.

DeLea Becker: Last minute, we are joined by one of my very favorite people, and he knows that.

DeLea Becker: My very own CPA, Bill Hamilton. Bill Hamilton. Introduce yourself. Who are you? What do you do? Why do you love DeLea ?

Bill Hamilton: So that should be obvious, right? Thank you DeLea. My name is Bill Hamilton. I am a CPA. I'm a partner in a , small regional accounting firm, headquartered in Salt Lake City. We have offices in five states, 14 offices.

Bill Hamilton: I'm also a real estate investor. I've got, and I work. for a number of years on a variety of projects, from leasing to renovation to sales. And also, I am a member of the Central Texas Angels Network, which we support and provide seed capital for startup companies.

DeLea Becker: Ooh, I didn't know that last

Bill Hamilton: month.

Bill Hamilton: I'm surprised.

Bill Hamilton: Learn something new.

DeLea Becker: Learn something new. I should put you on a panel more often. So welcome to the panel. I have some experts here to help me either a ask questions or answer the questions that get asked because I may not have all the answers. It's very surprising. I hope I do. But if I don't, I've got some experts here.

DeLea Becker: I'm going to actually have a Guy Dudley introduced himself. I had him also joined last minute because when you talk about commercial real estate investing often, if not all the time, people want to talk about syndication. I don't talk about syndications because I don't do them, but I have somebody here that has done them on the GP side, maybe LP side as well.

DeLea Becker: Every bit of it. And I'm going to let him introduce himself. So whenever you hear him talk, you know who he is.

Guy Dudley: Good morning. My name is Guy Dudley. I now work for Manhard Consulting. We're civil here in town, a nationwide company. So land development, survey, landscape architecture, in planning. And I think in a previous life.

Guy Dudley: I ran and worked for a development company for 14 years. So a lot of the syndications, I can tell you a lot what to do and what not to do. And personally, there are two projects that I am in syndication with now. Just running through my personal finances. Again, as Billy talked about, I can tell you what not to do.

Guy Dudley: Excellent. We

DeLea Becker: are going to just jump right in. Stephanie, as we started talking about buying a building, Actually, I'll say why I said yes to your question. I think she asked me about a year ago. She would like to invest in a building with me. And the number one reason I was willing to consider it is I have known Stephanie for 10 years.

DeLea Becker: So there's a lot of things that I know about how she does business, how she interacts in the world. I have an understanding of how she handles her finances. That's very important to me. She also understands who I am and how I operate in the world. If she wasn't okay with that, she wouldn't approach me about being a partner.

DeLea Becker: So I say that because I generally, I doubt that I would ever invest as a partner with anybody I didn't know really well. That's my number one tip. You should know who they are. You should know their reputation. You should ideally know some projects that they've done so that you know if they've got the tools, the chutzpah, and the caliber to go get it done, do what they say they're going to do, and weather the storms that are surely coming.

DeLea Becker: So Stephanie, what is your first question?

Stephanie Pierce: So we're going to start very simple, and how do you decide what building to buy?

DeLea Becker: Okay, DeLea's perspective is, I invest in office, retail, warehouse, and now I do land. I specifically do not touch multifamily. I own, sorry, I manage all the buildings I own. And I do not want to be regulated by federal law residential, so no heads in beds.

DeLea Becker: In commercial real estate, in Texas, we are landlord friendly. We like that. If a tenant doesn't pay their rent, we have to go through the process that is lined out in the lease, but we can lock them out and keep their stuff. You can't do that in residential. There's a lot more, triggers and things that you have to jump through.

DeLea Becker: So I stick to those exactly. Retail is my favorite. I really like office and I believe in it in 2024, which is why I'm building 50, 000 square feet of it a quarter mile down the road from here. Warehouse always good. Just always good. It is flex. You can go back and back. Fill it with some office space. Thats HVACed.

DeLea Becker: There's not enough of it, but if you have warehouse with yard, contractors really need yards for their fleet of trucks and vehicles and storage, all of that. And then land, and I am very late to the game because, the billionaires are gobbling it up here in Texas. But land, if you know what to do with the land, can be valuable.

DeLea Becker: You build in your value, your equity, whenever you build on it. Or the other one is you land bank. You buy the land and you just sit on it and wait for it to appreciate.

Stephanie Pierce: Bill, from a CPA standpoint, is there a reason to buy one versus another?

Stephanie Pierce: Great question.

Bill Hamilton: If you buy raw land, as DeLea said, you sit and wait.

Bill Hamilton: And sometimes I refer to that as a green alligator because it just eats money. It doesn't provide much from a return standpoint until down the road. Whereas if you're buying a property with a building on it

Stephanie Pierce: But would that be good from like a tax standpoint for some people? This piece of property is for sure going to be a loss every year.

Bill Hamilton: Not necessarily because you're probably not going to incur that many expenses other than property taxes. And maybe some maintenance, yard maintenance and that sort of thing. I would not do that as a tax plan factor. We have a saying in our firm that, don't let the tax tail wag the dog.

Bill Hamilton: In other words, we don't believe in doing things for tax reasons alone. And that we should do things for economic reasons. Now having said that, with regard to if you buy a building, then you have some depreciation opportunities. If there's equipment in the building or there's, if you do a cost segregation study on your building, then you can break down the different components within the building and depreciate them at a most much faster rate than the typical, depreciation recovery period is for commercial properties 39 years.

Bill Hamilton: And so that's a long time and doesn't generate much of a depreciation reduction in most cases. So it's very beneficial to do these cost segregation studies.

DeLea Becker: we'll tag Cost Seg on the end. Okay.

Stephanie Pierce: So still sticking with the basics. How do you decide on a location?

Stephanie Pierce: Is there we will only in this state or in the city or what's the parameters on that?

DeLea Becker: Okay. I'm gonna tell you my perspective and I will say as you are, talking to people about partnering with them. This is a great question. where they invest and why and what resources they have set up to manage and handle the project, the building, et cetera.

DeLea Becker: I personally have a rule. I have to be able to drive there within a day. And that was really set into stone during COVID whenever there were no flights. And if you were going to go anywhere, it was driving. So I currently own nine commercial properties. I have had, at least four cars run into them.

DeLea Becker: Say run into the corner of a building. Truck driver drove it through our 1101 East 6th Street, just right across the street. Bill Hamilton also had two cars plow into his building.

DeLea Becker: I thought you were gonna say he

Stephanie Pierce: ran into

DeLea Becker: them.

Stephanie Pierce: He's that was me.

DeLea Becker: It wasn't that I know of. I have checked the video from the cops and it wasn't you.

DeLea Becker: But, yes, fire, tornadoes, there's natural disasters. You, things can go wrong on a building that I personally, if I own it, and I manage everything that I own, I want to be able to get there and deal with the problem. Especially whenever your building is run into, usually the cops require you to come out.

DeLea Becker: They need the owner there to enter and make sure that everybody is safe. And that does happen because, ours had a residential tenant above the commercial that they plowed into. They were very worried that somebody had maybe injured inside. Also, this is personally, this is more taxes as well.

DeLea Becker: I understand Texas law and Texas taxes and all of those things. I don't really want to go learn another state. I only buy in Texas. I've been in Texas. Gosh, 44 years of my life. And all over Texas. And therefore, I really do look at buying all over Texas. Now, my favorite is East Austin. Next to that is, I like the outskirts of Austin.

DeLea Becker: MSA, the outlying areas. Everybody loves Taylor. That's not where I'm looking. Not by deal. Buda, Kyle, San Marcos, New Braunfels, Lockhart, Gerald, Salado, Belton, Killeen, Waco. I'll even buy Bryan College Station. I love Houston. I love Dallas. I love Fort Worth. And that is what I just pieced out is the Texas Triangle.

DeLea Becker: So I really focused on the Texas Triangle. And the biggest thing, Austin, Texas is very expensive because we have so many investors that want to be here that I don't spend a lot of time on it. I spend a whole lot more time looking in the outskirts. For some hidden value and hidden value for me is it's not much now, but in five years it will be or 10 years.

DeLea Becker: So that is really where I focus on looking.

Stephanie Pierce: Just pass that straight over to Bill. Tell me about it.

Stephanie Pierce: Where does he look?

Stephanie Pierce: No, but CPA wise, is there advantages to buying within a certain area versus not?

DeLea Becker: Income tax state versus non income. Take over that.

Bill Hamilton: Texas is not an income tax state, so that's always an advantage for doing business in the state.

Bill Hamilton: Texas is, one of, I think, nine states that do not have a state income tax, you have to go into any kind of investment outside the state of Texas with your eyes open, know what you're dealing with, and as Valise said, it's almost like having, all these different, Internal revenue codes.

Bill Hamilton: Each state is different in their requirements and rules. And especially if you get in areas like California.

Bill Hamilton: That's going to be my next question. Where do

Stephanie Pierce: you not buy?

DeLea Becker: Are we agreeing? We do not buy in California. I have no desire. None?

Stephanie Pierce: No.

DeLea Becker: Florida. I'm interested in Florida. I have a lot of friends in Florida.

DeLea Becker: I think that's the only reason. If they came with one, and that's, different than partnering with you. Who would I partner with where I'm not controlling the asset? It has to be somebody else in commercial real estate that has boots on the ground in that area. So I have some friends in Miami, Tallahassee, all over Florida, they're commercial brokers.

DeLea Becker: So I am always telling them, please find something because if it's in their backyard, I know they'll keep at least because they've got equity in it. And that is the key, in my personal opinion. People care more about their buildings and their properties when they have their own hard earned cash in it.

DeLea Becker: Period. It's significant. That's, if I were going to partner with somebody, let me back up, if I didn't own any commercial real estate, I would not partner with somebody that didn't own any commercial real estate because then you're both coming to it blind. I think you need somebody that's got some experience.

DeLea Becker: Sure.

Guy Dudley: Hey, what's

Stephanie Pierce: up?

Stephanie Pierce: Syndication wise, What are your thoughts, GP versus, I would, let's stick with the GP side of this, the general practitioner. What do you think for location?

Guy Dudley: I think the biggest thing when you have any kind of syndication, GP, LP, so general partner, delimited partner, you have to have understanding.

Guy Dudley: One of the biggest things, problems right off the bat is you think you understand what it is and they think they understand what it is and the roles and how they, how it's played out. If that's not crystal clear, that's a recipe for disaster. And on top of that, one of the things that we talked about through this is okay, industry friends.

Guy Dudley: That means we know a little bit about the industry and that's really dangerous because if we know a little bit about it, We tend to extend our knowledge of our one little area to the whole process. So we've got to be really careful. So I think back to your question is okay, what about location?

Guy Dudley: It's part of your planning. Billy was talking about, okay, you can land bank this, and Bill's talking about, okay, don't do it for a tax reason. However, if you have a plan, you're saying, okay, in 20 years, this land is going to be this and I'm okay with having a loss for 15 years. I'm going to get a tax write off.

Guy Dudley: It's not because of a tax situation. That's the benefit, but it's the goal of what you're looking to do. And back to what needs to happen when you're talking to your GPs and your LPs is why are you all in the same? Like, why are you doing this? To leave by talk. It's not good for people who have never invested in real estate to have never invested real estate together.

Guy Dudley: What is your goal? What is your goal? And there's a point. What are you bringing to the partnership? If you're The LP the limited partner and i'm just giving you five dollars And I'm not going to do anything as long as LP understand that versus no, I want to be there when somebody does run into the corner of the building.

Guy Dudley: All right. L as an LP, I'm going to be there. Okay. Make sure everybody understands that almost ad nauseum at the beginning, especially if you're friends in the industry, because this is one of the ways to kill friendships really quick. Because if you have some expectation of how this is going to run and it goes differently.

Guy Dudley: The fires are going to come, the floods are going to come, the problems are going to happen. It's how you're going to deal with it and make sure you set that up. Full circle, back to your,

Stephanie Pierce: full circle,

Guy Dudley: back to your location. It's what you're going to hold. If you just want to be the GP and the lead's okay, it has to be in one, one day's drive.

Guy Dudley: Okay, I can go anywhere. I'm saying me. A person, alright, anywhere in the country. Alright, as long as you both have that expectation. Okay. What is the goal for the syndication? And I think as long as that's hitting the goal, location doesn't matter. But that's for whatever each partnership is to

Stephanie Pierce: do.

Stephanie Pierce: Okay, makes sense. Next up, how do you actually search for the properties?

DeLea Becker: Ooh, goodness. You teed that up for me. Oh, okay, so how do I search for properties? There's the easy ones, CoStar, LoopNet, Crexie, okay? And Crexie and LoopNet both have a free version. It's Zillow for commercial real estate.

DeLea Becker: Anybody sitting here can go walk out there and start searching LoopNet. Now, you won't see all of the listings. But, Mez Brokers like myself, if I have a listing, I pay the extra money so it's on the free version. Bill and Hamilton's buildings are on the free version. I pay extra for that. Start looking there.

DeLea Becker: That's the easy one. Now, there's the harder one that's much more lucrative, but hard. Lucrative, hard. And, at our household, we call it bird dogging. And bird dogging is You talk to everybody, you shake every tree, you find out who the owner is, call them, be that annoying person that calls them, send them letters, send them cards.

DeLea Becker: Whatever you've got to do. Whenever you meet somebody at an event and they say, I used to work for Nate Paul. And I'm like, oh, really? This happened last night. And I'm like, I want these two buildings. And I don't know how many Nate Paul owned at one time. Let's just say it was 100. There's only two I want.

DeLea Becker: So I knew the addresses. I'm like, I want this one and this one. Can I get those? And now I have him going up the chain to find out if I can buy them because he has not lost them yet. That is how you bird dog. A lot of how I find buildings or find out what's going on, how I determine where I'm going to buy is networking, and shamelessly telling people I am buying.

DeLea Becker: I'm buying a deal. I got 2 million cash ready to close. I'll close in 7 days. I can close in 3. I need the seller to be crying at the closing table. I'm not paying 2021 prices. That is bird dogging. And other people have different ways of bird dogging, but the big thing, I sat on a panel yesterday for developers, and I told everybody there, if you want to learn development, you've never been a developer, you need to go learn from a developer.

DeLea Becker: It's the best way. You call up a developer and go, Hey, and I've had people do this, can I come learn from you? Oh, and can you pay me 50 an hour salary? That's great. And I'm like, no and no. That said, if somebody sitting here today brings a deal to me and says I got this deal under a contract, this is what I think can be done, I want to do it, to leave, will you partner with me and we go do it.

DeLea Becker: That's how you learn because you bring the developer the deal. Get out in BirdDog, find the deals. I've been saying this for years. There is no lack of money in the market, zero lack of money. Just because you can't get a loan doesn't mean there aren't a lot of owners sitting on a lot of cash, just waiting for a deal.

DeLea Becker: So if you're not the one with a lot of money, but you want to get a shot at buying commercial real estate, partnering with somebody that's very experienced and you can see how they do it, go find the deal. They've got the money, then you negotiate how you get cut in. That varies, there's 50, 000 ways to cut that.

DeLea Becker: But that's, go find the properties. Or dogging. Oh, a hidden, it's not so hidden anymore, but if you have access to MLS. Everybody in commercial real estate, a lot of us have MLS access on purpose because we want to find the Listings that may be listed by somebody that doesn't know what they have and mispriced.

DeLea Becker: Look everywhere.

Stephanie Pierce: Okay, so we have done our due diligence and we now have a property that we see on LoopNet. How do you decide how much that property will cash with?

DeLea Becker: Okay, let me think. First of all, due diligence comes after you find the building and after you have it under contract. You, say you go look on the Loopnet today and you say, oh my goodness, I found a little building in, you're in Round Rock, right?

DeLea Becker: I found a little building downtown Round Rock and it's two million to leave. Please look at this. First of all, it's downtown Round Rock and it's two million, so I'm going to look immediately. immediately. How do I determine what it's worth? That has a lot of answers simply because the easiest one is cap rate.

DeLea Becker: If it's got tenants in it, you take what they pay in monthly rent. After expenses, multiply that by 12 and then divide that by the sales price. So you come up with a cap rate. Now, this is really beneficial that we've just gone through in our generation, if you will, the federal interest rates going up.

DeLea Becker: Now, if a Chick fil a is on the market and it's a 3 percent cap rate. Why would I buy that if I have to pay 7 percent interest on it when I get my loan? I don't know that. I know their strategy. It's just not my strategy. So I'm always at least looking for a, a delta. There's a difference between what I pay in interest on a bank loan and what my cap rate is.

DeLea Becker: Now let's back out if you don't have a bank loan. If I can put my money in the bank, a million dollars in the bank, and I can get 5 percent interest, or I can buy a multi family project for four and a half cap, I'm safer with it in the bank. They're going to pay it. That also has throttled back a lot of buyers, because cap rates haven't adjusted with the interest rates, and banks are so cash poor, they're paying these high interest rates So a lot of buyers are just like, I'll keep it there.

DeLea Becker: It's nice and safe. We'll wait for a deal to come. Now, there's that one angle. Why would I buy a 4 percent cap rate auto zone on South Lamar, which I did two years ago? And the answer is, I'm basically land banking, because in 11 years that tenant's lease ends and I've got half an acre on South Lamar, across from the broken spout.

DeLea Becker: So about three years before that lease ends, we'll start entitlement and then we'll mow that to the ground and we'll go up something similar, I assume, to my 50, 000 square foot building on E7. So that's one way you value it. What does it work to land bank? And I also cost siped it and brought my taxes down $700, 000.

DeLea Becker: Yay! Oh my goodness! So it's like the, it's like the property that just keeps on giving. It just keeps on giving. So there's different measures of the value. And then there is, this little building has an owner occupant in it, and we say, I'm pretty sure I could get 30 a square foot, if we buy the building and we re tenant it.

DeLea Becker: So they have two years left on their lease. We have to know the market and that's when you study what can things really lease for. So you could go hear a panel and they say, Oh, retail is 40 a square foot. That's what you can get rent East Austin. It's 40. You have to really know the property because a you could only get 30 maybe because it's got problems.

DeLea Becker: It's got their parking. There's a bunch of issues against it, and that's okay. But the problem is. prices to come down because really it's about the income. Or you could know the area so well because you've been there 20 or years that you say, I know I can get 50 a square foot because I'm going to put a weed store in here.

DeLea Becker: It's going to be spectacular. So that building has more value. Now the seller may or may But you look at the building, what could I do with it? You can also look at it from a tax planning, even though you're not supposed to let it wag the dog. How much can I, if I cost segregate this, how much can I take advantage of bonus depreciation and get off my taxes?

DeLea Becker: And I've started to think about it this way. So I'm looking at a car wash. If I buy a car wash for a million dollars and I can cost seg it, This tax year 2024 bonus depreciate, which is 60 percent for 2024 tax year. Let's say I could not, my tax is down by $500, 000 in my 2024. Okay. I get to use that $500, 000 and go buy Bitcoin.

DeLea Becker: And then whenever I decide to sell the car wash or tear off the equipment, I have to pay recapture, but was it worth the recaptured money I paid to have had that $500, 000 at work in another investment for five years? And it gets a little complicated, and all of it does, which is why I always have a really hard time telling people, what do I buy?

DeLea Becker: Because it depends. It depends. What tools can I use to make money, decrease my taxes, build wealth? Legacy planning, what are my kids going to be left with, grandkids, great grandkids. And I will let you speak to the cost sag on this because it is important. It's a, one of the reasons I believe that prices haven't come down because it is a tool that a lot of people are using because they have large tax bills and this really is a great financial planning tool.

Bill Hamilton: Yes, it is. A cost segregation study for those who may not know. Basically, you're taking individual components within a building and you're trying to figure out or you're doing an analysis of what is the actual useful life of those components, whether it's the HVAC system or just any other, any of The different types of components.

Bill Hamilton: Oftentimes, these studies can be done very economically and they're very, worth the effort because you can really accelerate your depreciation and deductions as the lease stated that the bonus depreciation rate is 60 percent in 2024. It's dropping to 40 percent in 2025. Of course, we don't really know what's going to happen with the tax laws because there's so much discussion about a major tax bill coming through next year, and we'll learn, obviously, as time goes on, but, a cost segregation study is, for anyone who's buying any kind of a commercial building, is an absolute essential tool to have in your toolbox.

DeLea Becker: 100%.

DeLea Becker: And I want to know on the syndication, can you cost segregation and pass down that savings to LPs?

Guy Dudley: 100%. I don't know the answer to that question. I wouldn't think so, but I don't know. But to put that back to Bill, Does it matter from a cost seg standpoint, your timeline? If you want to own the land forever, does it matter?

Guy Dudley: Or are you looking to turn it around in five years? How is that different from a cost seg?

DeLea Becker: Recapture, I think.

Bill Hamilton: Great question. Yes, absolutely right. Recapture is the thing that can trip people up sometimes. And what recapture is simply is that, any depreciation that's taken on a property when you sell the property is quote unquote, recaptured, up to a 25 percent tax rate, meaning you pay 20 up to 25 percent tax on the appreciation that you've taken in the time you built the building.

Bill Hamilton: So if you do have a short timeframe, like you're saying five years or less. It may be good to really take a, take stock and say, is this really going to be worthwhile for me to do this? I will also add, however, that, again, the cost to do these studies is really, small. And I don't think it's a bad idea just to go through the exercise, just to see what the potential tax savings can be and then run the analysis.

DeLea Becker: I'm a huge fan of cost seg. So just note, I am looking high and low to find a car wash. Laundromat, anything, restaurant equipment, rapid depreciation, so anything like that, I need to close before 12 31 2024 so I can cost sighted and appreciate it.

DeLea Becker: Six weeks.

DeLea Becker: Yep, I can do it. What are you doing?

DeLea Becker: I'm talking to all of you here. Go look, you're my bird dogs today.

DeLea Becker: She can close in seven days.

DeLea Becker: I can.

DeLea Becker: Maybe three.

DeLea Becker: I can close, I'm ready. Oh, I can close. I can close tomorrow. I don't think the title companies can get it done fast enough. That's why I brought this. But yeah, no, no appraisal, no inspection.

DeLea Becker: Russ goes out and inspects. I have my own inspector. If I'm buying a deal, he'll be there in the next five hours.

Stephanie Pierce: Okay, so we now have a piece of property that we are wanting to put under contract. We know it's a cash flow. As the partnership, what contract? need to be signed because of this piece of property?

Stephanie Pierce: Are we creating an LLC? How is that part

DeLea Becker: working?

DeLea Becker: I have always created LLCs. I am sure there are other advantages to the S Corp or organization tools. Number one, I would have a company agreement drawn up. You and I have to sign a company agreement that we go through in detail. And I know the details.

DeLea Becker: You should go through it yourself. So I highly recommend you hire an attorney to do that. I highly recommend you know it. I don't believe personally, this is my own personal opinion because not everybody believes it. You shouldn't be doing commercial real estate. If you don't read your contracts, you should read your leases, your company agreements, your sales contracts.

DeLea Becker: You should know the impact. And sometimes so many people do not read contracts. I'm like, I'm not an attorney. Then you probably shouldn't do this because your attorney who's amazing. Let's say it's Kathleen Slack She is absolutely going to watch out for me, but she may not notice something that I notice it impacts me I should understand it.

DeLea Becker: I Probably do not want to have a partner that doesn't read the company agreement Think that would be concerning unless they are so experienced. They just know like it's not going to work Yeah, I reviewed it. We're good. I had to understand that. So we would have a company agreement drawn up. Generally, it would be one of my past ones that we regurgitate and change up the names.

DeLea Becker: Then we go get the building under contract. Let me say, we get the building under contract. We form the company. LLC. somewhere. Our company agreement. We form our LLC. We'll get back up to what was your question? Okay, we purchased the property in the LLC. Sorry, and I say this all because

DeLea Becker: the question was simply what contracts need to be drawn up. So you're covering that.

DeLea Becker: Yeah, the company agreement is LLC. And I, the only reason I'm stumped, Joel, is because I form an LLC for every single thing we purchase.

DeLea Becker: purchase and I usually do it three days before closing because I just whip it up but that's whenever we're the only purchaser so I don't really need to pay attention to those details. You and I would form the company agreement before that is the LLC that would purchase the building. I know please especially if you like SCorp better.

Bill Hamilton: I was just going to mention that, about the S Corp, I would not recommend an S Corp because, that creates a whole myriad of other problems, that, you don't have in a partnership arrangement for federal tax purposes, so it, I think an LLC is important, however, it doesn't have any impact on the taxes, that's just a legal maneuver, move to, to make to protect yourself.

I'm not an attorney, so I'm not giving any kind of legal advice I think you know DeLea is on track with forming LLC's for each of these projects And I think it's important to have separate ones There's a lot of flavors.

You can have a series LLC. There's all different types But I think it's a good idea to have some sort of a standalone entity for each property So if something because if something were to go wrong You wouldn't want Some attorney to come in and take all of your properties. So

DeLea Becker: Hold on militia And this is a very important thing If you are a landlord you purchase a building you now have a target on your back Okay, your assets are not protected only your house

DeLea Becker: probably

DeLea Becker: Exactly back up for backup. So thank you. Thank you. I know that's that I know it is very important to know, and some people that own commercial real estate really don't understand this. You have a target on your back, you have a target on your back, you have a target on your back. People can walk in, slip on a banana peel, they will sue you, your assets not protected.

DeLea Becker: Period. It is not. Having them held in different LLCs is an extra layer of difficulty. It doesn't mean that I'm 100 percent protected. And I, this is a huge one people don't realize at all. You can have all the protection in the world till someone dies. And when someone dies, it's all game. It's all a huge liability.

DeLea Becker: And it's very interesting that I have Bill Hamilton sitting here because once upon a time, I redeveloped a 111 year old building he owned, and he really wanted a outdoor patio on the roof. He's it will be so great. There's a downtown view. Come on, DeLea. This'll be amazing. We should have a patio.

DeLea Becker: On the top of the building and I'm like, Bill, No if someone falls off, guess what they're taking your building and he's Oh, I didn't think about that. So I am very proactive in buying assets and making sure I reduce risk of people getting harmed or dying because it can happen. Again, you have a target on your back because you are already as a commercial real estate owner in a whole different echelon.

DeLea Becker: You are in a field of people that have an attorney, five attorneys, 10 attorneys. They've got one CPA. They got five CPAs. They have so much layers. of professionals watching their back. Yes. So I'm not saying you have to have that layer to start out, but it's generally what happens. And that's really more of a, I tell people that are getting into commercial real estate be careful because the landlord will sue you chase you just to make you suffer.

DeLea Becker: Cause that's what happens in our industry.

Stephanie Pierce: I just wanted to add in about finding a good lawyer or attorney that you can work with. That's very important because all of the, therefore, after Afterwards and contracts is very confusing to me. So I will go up. I will mark up everything that I don't understand and yes, my attorney is looking it over too, but it makes it where I can go in ask my questions and if we don't speak the same language, I have the same problem with CPAs.

Stephanie Pierce: Like I don't speak the same language as you. I need you to dumb it down where I understand it. So making sure that you find a good attorney that you can work with is very important too. Okay, we have found our piece of property, we have formed our LLC, we have bought our piece of property. As two partners, going in 51 49, how are the responsibilities broken up after we bought the building?

Stephanie Pierce: Somebody's electricity goes out, we have a water break, we have somebody run into our building. What happens and who does what in that situation?

DeLea Becker: And as you're selecting a partner, you're talking about partnering with somebody. Those are conversations you really need to have then. And I, she clearly has had that conversation with me cause I've made it very clear. I'm 51%. I'm 51%. I'm in charge. I do it all. I make all the decisions. I'll let you know.

DeLea Becker: Maybe. Most part, I just go do my thing. Bill Hamilton knows. But if you know me, You find a degree of comfort with that because you know I'm going to go do it. And some people really appreciate that in a partnership. Some people want a partner that is reporting everything, always talking to them, making decisions with them.

DeLea Becker: And those are valuable if that's what you're looking for. And there are partners that do that, more of a consistent, this do, let's talk about it, let's talk it through. Generally, let's say a air conditioner goes out on the building. Okay. I'm managing the building. There's two ways to look at this, which is.

DeLea Becker: Actually, I'm going to go 10, 000 feet view and say, number one, whenever you select a partner or you're considering partnering with somebody, it is very much a marriage. So A, the company agreement is a prenup. Okay. So it dictates how this is going to break up because it may, hold on. Usually it will.

DeLea Becker: And that doesn't mean it's bad. You might sell the building. Done. But sometimes it is somebody wants out and that is better to get out of the way and the front end. So whenever it occurs, it's just do you walk through your agreement? In the Bible, it's called being evenly yoked. I personally would not invest with somebody that was not evenly yoked financially to me.

DeLea Becker: It does not mean that they have to have an equal net worth to me. But it does mean that they have substantial means to weather a storm. The problems that happen. If we have a cash call for $20,000 to replace the HVAC that needs to happen in three days. If you have tenants, they need air conditioning. So number one, find somebody that's evenly yoked in that way.

DeLea Becker: Because when the HVAC goes down, there's either you have reserves, Or it's a cash call. A lot of people do reserves. I think in syndications, it is very common that there are reserves because people don't want to do cash calls. And that's wonderful for me. And if I'm a partner with one person, you and me, and let's say we have a hundred thousand dollar income off of our building in Round Rock that we bought.

DeLea Becker: It's a little historical building. We love it. And I know that we're going to need a roof replacement in five years. Because we bought it, it was priced accordingly, and we're going to need new air conditioners. Okay, I could keep that $100,000 that year in the LLC bank account, but you and I have to pay taxes on it.

DeLea Becker: So I'm, my CPA is going to do my thing and he's going to go, yeah, I mean you, you owe your taxes on your $50,000 and I might say, but my, but it's sitting over there in the bank. Why do I have to pay taxes? And it's passed through taxes. So we have always come from the angle of, if it's my money, I want my money out.

DeLea Becker: And if I got to put money in, I'll pony up when the time comes. And that also comes from, I could take the $50,000 that's sitting there in reserves and could put it in Bitcoin. I might turn it into a hundred thousand. in the time before we replace the roof. Again, evenly out. You really need to make sure your partner's in tune with how you want to operate.

DeLea Becker: And you might have a partner like myself, then you say, DeLea, I really want you to keep it in reserves because if it's in my bank account, I'm going to spend it. We're probably not going to be partners anyways, because that's already a concern. Commercial real estate, you should have reserves in your bank account for lots of things.

DeLea Becker: But you could say, let's keep it in reserves and. Then I can plan and do accordingly. We have six partners on our 2422 East 7th I will as the asset manager keep some in reserves I won't disperse it all just because going in cash calling six people and it's a large enough building that keeping Reserves amount there makes perfect sense, but our 1 million dollar building in Round Rock we could decide But that is important.

DeLea Becker: So now let's say You I've dispersed the money. We've got to do the roof and the HVAC. It's a $100,000 bill. I call you up and I'm like, put in your 50,$50,000'm writing the check and you're like, I don't have it. I'm like, okay, cool. So per our company agreement, I'm going to lend it to you. I'll put in your $50,000, no problem.

DeLea Becker: And our company agreement dictates what that interest rate is. And when you have to pay it back. And if you don't pay it back, what happens? So the wrong part about going into investing with a friend, it's business. It is business. It is business. If I loan you $50,000, I'm going, if my company agreement says 7 percent interest rate, I'm charging you interest.

DeLea Becker: Because you're my friend. It doesn't matter. So that's again why you always read the company agreement because your attorney, Kathleen Slack, she'll read that and never pause at it because of course that's in every company agreement, but you didn't realize it's there and I'm charging 7 percent to you.

DeLea Becker: And all of a sudden you go I thought we were friends. Why are you charging me interest? Like you're borrowing my money. Why didn't you have your money ready? But, and this is choosing a partner wisely, you might select me as a partner specifically because I can carry the load. I would have no problem loaning you the money because now I'm getting 7%.

DeLea Becker: I'm super happy. It might be in the company document that company agreement that if you don't pay me back in a certain amount of time, I take it. I get your shares. Cool. I'm in this to get more assets. And it will probably end our friendship, but I really don't care. Not at that capacity. I will help you.

DeLea Becker: I will carry the water up the mountain. But at the end of the day, it's business. And that is why you have to know who you're partnering with. Because there are nicer people than me. I am not everybody's cup of tea. I can be pretty shrewd and ornery and ugly. And I will be. But it's all legal.

DeLea Becker: And you signed the doc. Evenly yoked is important. And that's if you did want to be a new investor and you go get with somebody that's a little bit of a new investor, that's not a bad thing. And you go buy a $300,000 property so you don't have an $80,000 roof to put on because it's a much smaller property.

DeLea Becker: Size matters, evenly yoked, and that is a big one. Financially I am not sure. No, I can say this. Absolutely. I have seen people's financials, their net worth and they drive around in fancy cars and they have everything fancy and they really don't have a net worth. Probably not my partner.

DeLea Becker: That's just not my partner. I do gravitate towards the people that drive a beat up Dodge truck. I should say nice. My husband drives a nice Dodge truck. Yeah. Wear red wing boots, steel toe. Those are my favorite. They're out working every day and you would be shocked if you knew their net worth, it would blow your mind.

DeLea Becker: The, those are more my partners in specifically because if there's, okay, cash call number one, but here's a big one, you go invest with a friend and you tell them I've got a five year exit plan and they, in their mind, go great. My, my son is going to college in five years, so we're going to exit and that's his tuition.

DeLea Becker: Huh. And this happens a lot. Okay. In five years, we're in a recession and you call me and you're like, but we, I need that for tuition. I'm like no. We're not selling. Like, why would we sell? We're going to lose money and we'll hold it three years. We're going to be just fine. You can't pay your son's tuition.

DeLea Becker: So that's unevenly yoked. I really want to do business with people that can, that is in my mind, Vegas money, it's fun money because you can leave it in there till it comes back. Real estate. Always. Legally as a broker, I can't say this, but as DeLea Becker, the investor and owner, I can. If you hold it long enough, it always makes money.

DeLea Becker: It's going to appreciate. The people that lose money in real estate, Commercial real estate is because they got in a bind and they had to sell. They had to sell whenever the market was down or something with, they needed the money. They needed to get the money up. Otherwise you just hold. And that's as a buy and hold cost seg recapture doesn't affect me because I don't ever sell it.

DeLea Becker: A kid's allowed to pay recapture? I don't, no, it all goes, yeah. You never sell it. It never sells and it all goes into trust. With the recapture also? Oh, good to know. Okay, recapture is also in that. Okay. Did I answer the question? I forgot what it was. You answered it at the beginning. Okay. I hope this is all helpful.

DeLea Becker: Yeah, of course.

Stephanie Pierce: And then syndication. People who know a little about syndication know the answer to this. But can you give us a short version of who has responsibility then?

Guy Dudley: Usually it's the general partner. Typically the difference between the general partner and the limited partner, the limited partners just putting in cash.

Guy Dudley: So it's just how much their liabilities, what they put in general partner usually doesn't put in as much cash, but they put the sweat equity in. It's usually their responsibility, and I say usually 100 percent because it's all in the agreement. One of the things that I wanted to touch on, I am not an attorney.

Guy Dudley: Please fact check this. But one of the things that is my understanding, talking about an LLC, whatever you put in, that percentages, that's how much you get out. You don't have a choice. So you're 51, you're 49. At the end of the year, whatever you decide to do, you're getting 51% and you're getting 49.

Guy Dudley: One of the things with an LP that can be completely different depending on the agreement. So it doesn't have to be proportional to the amount of income that you, or how much you put in for equity. So that's one of the things. And so because of that, it's, I think in an lp, in a syndication, your company agreement is even more important.

Guy Dudley: Then an LLC. But, to answer your question, it all puts that together. It's all in the agreement.

Stephanie Pierce: To clarify that in terms, so that I can understand. I know.

DeLea Becker: Are they separate? Company agreements separate from LLC?

Guy Dudley: No. An LLC is the way it's put together. Yeah. There's a company agreement for an LLC.

DeLea Becker: Okay.

Guy Dudley: For an LP, there's a company agreement. Okay.

Stephanie Pierce: And we would have to get an attorney involved, but I think it has more to do with your, for how much, like what your partnership says, your LLC says. Distribution wise. So I own 51%. She owns 40, she owns 51%. I own 49%. But if I randomly only put in $10,000, that 51 49 is still it holds true.

Stephanie Pierce: So I don't think you were saying it has to do with how much you put in. Yes, I understand that would be correct. But I think it has to do with 100 like your actual agreement more than how much money was actually put in. We'd have to talk. Yeah. Yeah. Cause okay.

DeLea Becker: Yeah. Cause sweat equity can count and that's not equity.

Stephanie Pierce: And say that's what I'm thinking.

DeLea Becker: The company agreement, how you decide who owns what percentage is negotiator because I may put in a hundred percent of the equity and give you 10 percent in the company agreement.

Stephanie Pierce: So we would have to

Guy Dudley: check on that.

Stephanie Pierce: Yes. Correct. Check on that.

DeLea Becker: Hold on. We've got Jim wants to chime in.

Bill Hamilton: I'm curious if Guy could touch on I was wrong on the last one. No.

Stephanie Pierce: That's actually my next question for everybody.

Bill Hamilton: Yeah, great timing, Jim. Again, I'm going to go back to, it's the agreement. It's before any of this starts, this has to be ironed out. Me personally, in syndications I've done in the past, usually there's a, back to the waterfall, the LPs who want to put their money in, You try to get them their money back fast as possible.

Bill Hamilton: But once you hit that threshold, then the percentage back to the L. P. who did all the sweat equity gets it because I'm sorry, thank you. The G. P. gets maybe a higher proportion and as that moves on. And but as for distributions, that is also part of the agreement of to the least point. How much reserves do you want in there?

Bill Hamilton: Because, okay, things are going to go wrong. The larger, usually don't have a syndication for a $250,000 building. You usually have a syndication for multi millions. When things go wrong, it's usually going to be more, so it's better to have some sort of reserves. The more partners you have in the syndication, the even clearer, I think, you need to have this put together.

Bill Hamilton: But it's all stretched out, so in the past, just to bring it back around, Get the money back to the LPs as fast as possible because then they're happy then you're playing with free money Then because if it all falls apart it's usually the GP's fault or it's on GP's shoulders. I saw it on their fault.

Bill Hamilton: They can't control a lot of stuff But the LPs put it to risk the GP maybe just put a little bit of money and reputation at risk And if it all goes wrong, then It's not good. Let's get the LP guys back first. And then does that answer your question?

Bill Hamilton: I've done that multiple ways. We, there are agreements that I've been in that have a preferred return, that it's a running preferred return, whether it's 5, 6, 10, 12%, like you're getting that regardless. And if you can't pay it, It usually some some of them can accrue some, it's just flat. You have a 12 percent it's sitting in the bank.

Bill Hamilton: It's not building you any more interest, but once that funding comes around, because a lot of real estate projects, you start off with some raw land. It's going to be, especially if you're here in the city of Austin, you're any appreciable size, you start the project. It's three years till you're done.

Bill Hamilton: So obviously you've got a preferred return that's just going to sit there. But then part of the agreement is once the money starts coming in, that will dictate how it turns out. For example, you're doing a multifamily or you're doing an office building. Once you get the TCO or CO you're not getting rent yet.

Bill Hamilton: So maybe that happens near the end of the year. There's no cash there. The next year, maybe you're not fully leased up. That's all broken up. Usually, you have some for reserves, maybe the GP gets 10 percent of whatever that income's gonna be, and that 90 goes back to the LPs. Or just coming in through it.

Bill Hamilton: And as that speeds up, that helps it. And then once that waterfall is hit, once the LPs get X amount of dollars back, or once this threshold is reached, then that percentage changes and it goes through. But again, it's all spread out and it's all over the board. Cause it's going to boil down to what is the point.

Bill Hamilton: Like the very beginning of this podcast, I was talking about, Oh, we're just going to hold this land for 20 years. The expectations to the LP over those first 15 years could be next to nothing. Oh, if something happens, that's great. It's usually in there. Does that answer your question?

Bill Hamilton: I think it would depend on what product type it is. Literally, industrial, oh, it would be a lot higher. Right now, it multifamily, I think would be a lot lower. Now, I honestly do believe my own opinion on this. We're gonna be running into this problem again in 26. We're not going to have enough multifamily square footage available.

Bill Hamilton: So the guys that are starting to get on that, if they're have any wherewithal, they're like, okay, I want more of a preferred return for this to get going. But I think it's going to be so danger question. No, I couldn't tell you exactly what it's gonna be because it will be across the board. I would say 11 on that.

DeLea Becker: This is my personal opinion, which you're getting a lot of. That's why this is called a candid conversation. I also believe the preferred return is definitely tied with the experience of the developer and the syndicator. Period. Because if you go invest with a incredibly experienced developer, syndicator, general contractor, all of those things are lined up, you're not going to get as high of a preferred return because you know it's going to get done.

DeLea Becker: Much less risk. They will carry the water up the mountain, they'll carry it down, they'll get it done. So I would, if I was looking at syndications I can't imagine I would invest in one that was risky, but if it were, you're gonna want a higher preferred return. And honestly, if I looked at a syndication that has a higher preferred return in it, it's pretty much a highlight that they're inexperienced.

DeLea Becker: So but that can be an opportunity. That can be an opportunity. It's whatever your goal is. They're buying investors, which is concerning. If you haven't seen my wonderful East Austin Coffee panel where Guy and a panel of experts talk about construction quality. I can't tell you how many buildings are built, developers there are.

DeLea Becker: G. C. Syndicators, etcetera that never pay any attention to construction. They just look at spreadsheets and go, Oh, goodness, I'm a financial expert. That's great till the buildings on the ground and then you can have problems. So that's if I've if I do, I've looked at syndication packets before and whenever it's like this huge numbers and my I.

DeLea Becker: R. Is 35 percent like, First of all, you're like not calculating for anything going wrong. Who's buying this? Although he has, but Opportunity's own and he's killing it. So he's right. I was wrong.

Stephanie Pierce: We'll stick around to distribution.

DeLea Becker: Oh, I will. Okay. So I this is know your partner and ask them how they're going to do it.

DeLea Becker: I personally, if I was in a huge syndication, I'm probably going to want my monthly disbursement check monthly. I would want it monthly, maybe quarterly. I, my buildings are smaller, like my 2 million one. It's a little bit more South Lamar. I spend disbursement checks twice a year, pretty much whenever I do taxes.

DeLea Becker: So I do my, what do we think we're going to owe in taxes in April? And I send a disbursement check to me and the partner. And then back in October, cause the partners always extend as I do, I send a disbursement check. So it's you're going to have to pay taxes. Here you go. That's one of the ways I've disbursed.

DeLea Becker: You might do it quarterly, but again, on a $2,000,000 property sitting around and doing accounting to send $3,000 checks every month, that's a tedious process. If they were $30,000 checks once a month then, probably change to that,

Guy Dudley: but I think one of the things also is what kind of project if you're buying a building that's already has cash flow, you have tenants, maybe that makes more sense.

Guy Dudley: But if you're doing a greenfield, you've got raw land. It's gonna be a long time till you have things. So personally, I've done it quarterly or even yearly, just because it takes a while. And maybe once it gets up and running, that makes a whole lot more sense. Because then back to your point, it's my cash.

Guy Dudley: I want my bank. So do something with it from your opportunity cost.

DeLea Becker: He's got a question.

Audience: Yeah, I have a question on just like financial incentives for GPs. For example, he's responsible

Audience: for X, Y, and Z. What are your financial incentives? How do you get that versus an LP investor? Maybe it's the waterfall where you get a disproportionate, certain hurdles. Or maybe it's just simply fees that you take for managing the assets. I just wanted to hear a little more about that and some of the simplications you guys may have.

Stephanie Pierce: That's only you. I can tell you what I've read, but I've never done it. Yeah.

Guy Dudley: So to that point, I'm going to ad nauseum. I'm going to go back and hit on it's in whatever the company agreement is. It's very set up. Now, if I'm doing a project and I know what's happening, like I'm dialed in, I've done this 300 times.

Guy Dudley: Look, I've got LPs coming in. Look, I've got this project. I don't need the LPs. Maybe I want some LPs. Maybe I've got some political things that I need with these LPs. Or they're friends that have money. Okay, we're gonna come in and it's gonna be a lot less. It's gonna be a lot more in my favor. Or I turn around and I've got a new project that I'm not in this market or I don't know it very well or there's some sort of hole I'm trying to fill in my knowledge gap or in my skill set.

Guy Dudley: And I bring in other LPs. They've got a lot more bargaining power through that. So back to who's responsible needs to be right up front, because, for example, if I have doing a project and I'm a civil engineer, I'm more of the construction building side of this. I've had partners and LPs and the LPs are brokers out.

Guy Dudley: Now we have an agreement, but then outside my company X then hires that broker to be the leasing agent. So then that's something outside here that I know they have more things that helps. Then that circles background. I think one of the biggest things now that I'm talking this out loud is a lot of problems, especially with friends in the industry back to.

Guy Dudley: We all have different skill sets in this, but we lump it all together. And that's really, you've got to keep it separate. You've got to be I am G. P. I am L. P. This is company X may hire some of these LPs. People, what they do, but then there's an agreement between them, and make sure that you don't confuse the differences.

Guy Dudley: And then back to, in the agreement, if, talking about who, knowing who your LPs are, what they want. If I know that you're going to use this for college tuition, alright, I know that's happening, I know that distribution comes through. Alright. We need to go through that. And if I'm okay with that and if you're okay with it not happening in five years, I need to know that's an agreement.

Guy Dudley: I know that you're planning on these distributions to happen quarterly. Oh, you need them monthly. All right. Maybe that's not a good fit for us, or I'm absolutely fine with that.

Audience: That's a good point. So a thing on that, those,

Audience: Syndicated deals, because we have additional partners, are you talking to

Guy Dudley: 100%. It's not necessarily just buy and sell. Think about this. So every time you in any time you buy any real estate, I completely agree with the panel saying, put your LLC, especially when you have a syndication, you're building a little company like this entity is created to do X. So just like any entrepreneur, Oh, here's your business plan.

Guy Dudley: This is what we're planning to happen. Probably not going to happen that way, but you've got to plan for that. Now, you're not going to go down ad I guess you could. I've never gone down ad nauseum every possible iteration of what might happen. But you've got to get to a point, especially with your partners, and I'm going to, just real quick, if you've got 60 partners, it's a lot harder to do.

Guy Dudley: If you've got three, it's easier. But you've got to know what your goal is. What is the goal of this syndication? Because if the goal of this syndication is, I need, I want to make 18%. Okay, great, as long as you understand that, then you as the GP are going to make decisions to get to that 18 percent versus, hey, this syndication, we're going to hold this for 20 years.

Guy Dudley: Okay, that is a whole different thing. So coming in, or I need cash flow this, I need whatever you're building this for. That's it. Because that's going to inform the decisions. I don't know which author wrote it, but they begin with the end in mind. Where are you going with it? And I think that's the number one thing.

Guy Dudley: Because a lot of people think, especially if you don't do a lot of real estate, or haven't done this for a while, it was like, Oh, yes, it's easy. I'm just gonna go give some money to this developer. And I'm starting getting checks coming in. Yes. Alpha to the omega to beginning to the end. That's how it works.

Guy Dudley: But there's a whole lot that happens between that. And you got to make sure that's clear.

DeLea Becker: No, we were to Before we move on to that question, because Bill's got an answer.

Bill Hamilton: I was just going to add a little something that's a little bit related. But if you're going to go into kind of any kind of a real estate investment like this, make sure you consult with your attorney because different partners, types of partners have different limits of liability.

Bill Hamilton: Limited partners have limited liability. Usually it's up to the amount they invest. General partners typically have unlimited liability. So that's very important to know and go into with your eyes open.

Stephanie Pierce: I'm gonna go hand her the thing. I would also say from the research I've done it's definitely a dependent thing.

Stephanie Pierce: It changes all the time. Okay. Yep. Okay. Yes. No. Sit down. Really quick guy because I will tell them. I'll be right back. Okay. I'm going to do this.

DeLea Becker: Because all three of you are good for this. Also whenever you are choosing, Guy touched on it selecting partners, whether it's syndication, you choose your LPs, or I don't do syndication, so it's just I want them in the LLC and on title with me.

DeLea Becker: Strategic strategy. I have gotten to a point in my career where I will actually take partners specifically because I want them in my back pocket. They bring something to the table that I may not need today, but I might need it in 10 years. They're in the industry, they've got Significant experience in a certain expertise, like law or like CPA.

DeLea Becker: She is a architecture firm. So she brings a key thing whenever I'm ready to go redevelop it. And this is specific to personalities. It's hard to find people in this world that you really think the world of and trust un, just unapologetically trust. And those people I actually go seek to partner with.

DeLea Becker: So I think that's, I make sure we're yoked. I make sure that financially we see the same way. But now it's much more of a strategy, which is I always, I tell people like, If I partner with you, great. It's not because I need your money. I'm not going to do it because I need your money. There's a existential reason why I'm doing it.

DeLea Becker: And so I look for partners in that way that I can just, because once I have them in a deal, it's not like they can get away from me and they have to take my call, which is amazing when I need legal advice. Construction advice things like that They always answer my call because they might think they're getting money and I'm like no, I've got a problem Can you fix this?

DeLea Becker: So I wanted to say that because guy is actually been brought in on our E 7th project Specifically for that because I've known guy for years now He operates in the world that I wait the way that I do and he comes with the Extreme expertise in things going bad, which is valuable. So valuable. Education, experience, all of that.

DeLea Becker: So sometimes partners are actually selected simply for who they are and what they bring to the table. The money is just part of the deal, but it's really not why they're invited in. Now we'll let you go.

Stephanie Pierce: What's your question?

DeLea Becker: Say goodbye to the camera.

Guy Dudley: Back to what Bill was talking about, the liability, the whole reason you set up companies is because of liability. You're protecting yourself. And to Bill's point, GPs usually have. There's no cap on their liability. So I don't know legally if you could get out of a GP without dissolving the whole thing or having somebody come in their place.

Guy Dudley: That all being said, you can write anything in the contracts. And as long as it's the agreement. I don't know, I don't know if you could do this, but if you have an LP that is willing to become the GP and then you switch to LP, I think you could do that, again, from a tax and a liability standpoint, as long as somebody's on the hook.

Guy Dudley: I think that's all the law really cares. Make sure there's somebody who can be accountable if something goes wrong.

Audience 2: I've had that issue with GP passed away.

Stephanie Pierce: Oh, yeah, I can see that.

DeLea Becker: Which, ideally, you have that written into the company agreement in the first place.

Guy Dudley: But to that point, was your GP a person or was your GP another entity?

Audience 2: I don't know. It was a person in this case.

Guy Dudley: Obviously it coming in now. But yeah,

Audience 2: it was.

Audience 2: Yeah, they did have things written down.

DeLea Becker: And that is contract law. Contracts matter. You should have contracts. You should have contracts. And to amend a contract, you can always amend, but everybody has to sign. It's not oh, we're going to amend this, toot. So I would say if you're in a syndication with 80 people, that's going to be a little rougher.

DeLea Becker: If you're in a syndication with three and y'all know each other, it's probably going to be a quick amendment. Because it's, hey, I'm amending this and I'll send it through DocuSign. And everybody's like, all right, cool. Yeah, so because things change people die people retire all of that guy. Thank you for your brain and your beauty released Brain beauty and brawn that's Guy Dudley and he's out

Stephanie Pierce: So I only had one Final question and it's not even a super amazing one.

Stephanie Pierce: I just it's as we were talking here, remember my last questions about distributions. When do you decide, okay, we have this piece of property and it would be a perfect place to have, obviously we're not doing rooftop lounges, but using that as an example, this would be a perfect place to do a rooftop lounge.

Stephanie Pierce: How do you decide when to put the money in to the building to have a value add?

DeLea Becker: It does. I would say whenever the market dictates that it's a good idea. Oh, I think if you and I go buy a historical building in Round Rock, and not designated historical because I don't buy those. I don't.

DeLea Becker: I want full control of my building, not historical commissions. We would have probably sketched it out on the front end, like going into it. I'd go, okay, someday we're going to do this and I need you to know because you're going to be the architecture firm that does it right. And I'm going to be watching the market, or maybe you watch the market, or maybe you meet somebody at a crew or CT car event that says, I'm looking for this.

DeLea Becker: And it's got to have this. And you're like, I own that building. You're going to call me and go, I got the tenant. Let's roll. That's, it happens that way. There've been many things. That I bought and said in five years, sorry, 10 years, I'm going to develop this. And all of a sudden, three years later, I'm like, I got to develop this right now.

DeLea Becker: Like it got here way faster than I thought. But I have something sketched in my mind. But let's say we've got to go redevelop the building, put in a restaurant. We're going to do the tenant finish out. We'll go do it all. Cause then we can cost seg it. And it's appreciate. It's going to be lovely. And we need a million dollars to do that.

DeLea Becker: Now in three years ago where we bought it, I didn't make sure you had a million dollars. So I'm not going to expect you to have a million dollars in the bank. And that's, we would discuss should we go get a loan? Let's go approach some bankers and see what kind of terms they're going to give.

DeLea Becker: If one of us has the cash to say, I got a million dollars cash, I can cost seg it. Then we, I don't know it'd be amending the company agreement, but we would write something and actually sign it. I will do this million dollars worth of work. I'm going to charge seven percent. Interest, just like a, lender would to the LLC do.

DeLea Becker: And okay and that's what I love about commercial real estate and I would only want to do, I would only want to have partners that understand I'm looking for the next thing. I'm looking for the next thing. Otherwise, I'd buy a Chick fil A and get three and a half percent return and just sit there.

DeLea Becker: Way safer. No, Chick fil A is not going anywhere, but I'm looking for the things that, what can I do with it? Five, 10 years and looking strategically with you and as a partner, I want to utilize your skill set. That's the value you bring to me. Remember, I don't need partners. Say, what am I going to get out of this that brings me value?