"We've Never Seen Anything Like This" - Warehousing Demand SOARS

“In some markets, we’ve reached over 99% capacity…” -Doug Kiersey, President of Dermody Properties

America’s warehouses are bursting at the seams: Critical Supply Chain Link sees Surge in Demand

Driving home one evening in late November I heard this NPR story perfectly surmise the current state of the warehousing market. Spoiler - it’s bonkers.

In a matter of a year, warehousing rents in some markets have doubled. New buildings and industrial parks that would normally sit vacant for months are selling space before they're even finished - with bidding wars driving up asking prices.

These two graphs, courtesy of JLL’s incredible database, show current warehousing inventory at the end of Q3 2021 (above) and % changes in rental rates from Q3 2020 to Q3 2021. Despite staggering increases in inventory, prices are still up 7.1% from Q3 2020 across the US market.

More insights from JLL’s Q3 2021 Industrial Market Database and Analysis

Essentially, the recent run-up’s root cause is multifactorial:

Pre-pandemic, warehouse space was already scarce with upwards of 90% occupancy in some markets.

In 2020, the pandemic economic slowdown caused more and more products to pile up in warehouses as demand shrank along with the labor required to move goods. Simultaneously, online consumer spending rose a staggering 40% from 2019 levels.

Cut to 2021, and consumer spending is at an all-time fever pitch as pent-up demand, inflationary fears, and the looming holiday season encourage retail shopping.

But the truth is, all of these drivers pale in comparison to a market-wide shift in supply-side economics brought on by the pandemic and resulting supply chain meltdown.

An estimated 500,000 shipping containers await processing outside the ports of Los Angeles and Long Beach, October 2021 via CBS Los Angeles

In response to increased shipping costs, labor shortages, and soaring demand retailers and producers alike are moving away from the “Just in Time” model of production to what some are calling, “Just in Case” production - hoarding consumer products and raw materials in excess of current demand to help weather supply-chain shocks and changes in consumer behavior.

Collectively, these forces have fueled a market for warehousing space that is, “Completely unprecedented,” according to Doug Kiersey. And with container ships still waiting in long queues at ports from New York to California, nobody is sure when the backlog will work itself out - some have estimated years.

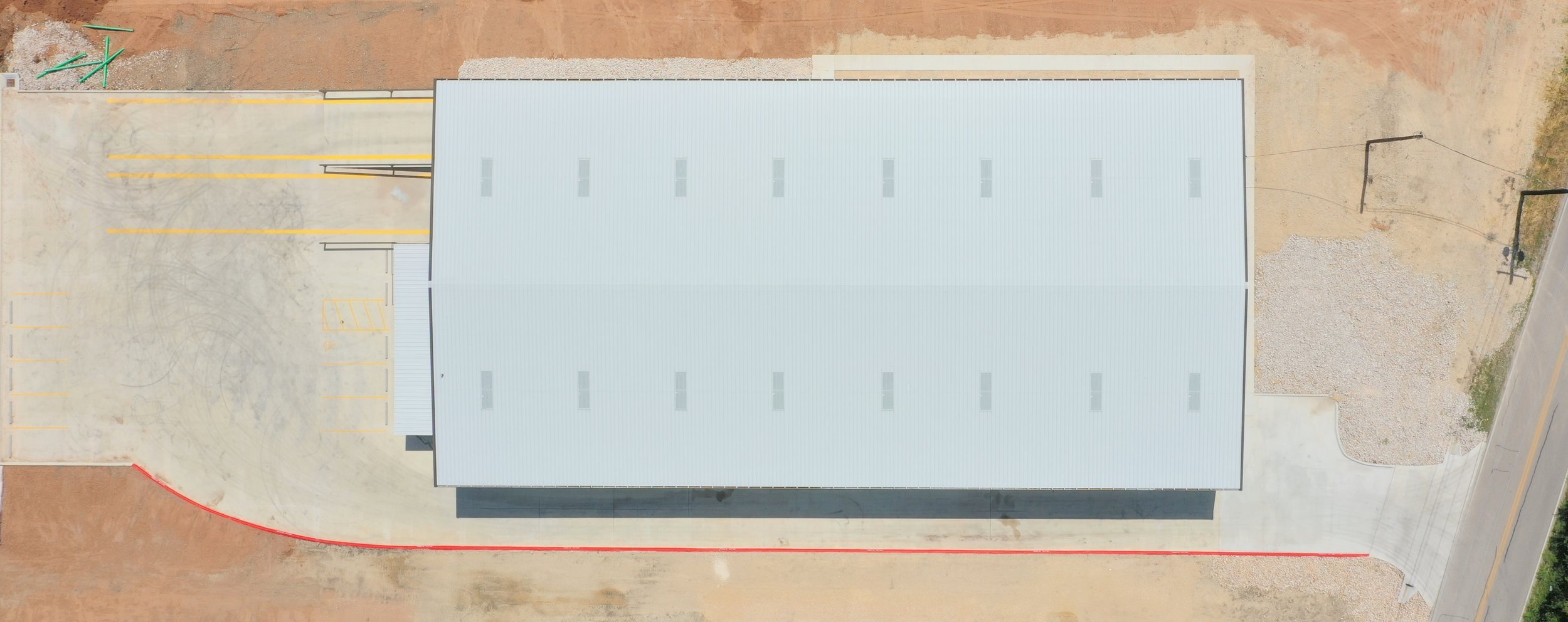

12955 Wright Rd - Beck-Reit’s Latest Acquisition

All of this news has us all the more grateful to have been able to close our latest investment, 20,000 sqft of brand-new warehouse space at 12955 Wright Rd in the SE Austin Suburb of Creedmoor, TX. We knew the property was a deal regardless of the rumors of prolonged supply-chain bottlenecks. Our primary factors of analysis focused on quality of construction, price per square foot, and location. What we didn’t know back in June was just how crazy the industrial market was going to get - doubtful we’d be able to close the same deal today.

Originally we had planned to market the property for lease with a 3-5 year NNN tenant in mind. What we didn’t expect was a slew of offers well above our closing price in just a couple months time…

With the holidays fast approaching we decided to play it safe and sign a short-term NNN lease with a Spa maintenance company that needed storage through May ‘22. We felt it was smart to get cash flowing instead of risking a buyer backing out right around Christmas.

But the listing is still live! Looking for Industrial space beginning May of 2022? We’ll be ready to lease! We’ve received a handful of LOI’s for purchase as well and are considering all of our options on the property. See listing info below and contact Beck-Reit Commercial Jim Rourke for more information! jim@beckreitcre.com

12955 Wright Rd. Creedmoor, TX

The Building Features...

Grade-Level and Dock-High loading (16 ft. height) 18-22' clear height

3-phase, 600 amp electric service

Fully Insulated Structure

Skylights Throughout for Natural Light

1,500 SF HVAC office with 2 restrooms

5 Minutes East of IH-35 & 10 Minutes to Tesla

Close proximity to Formula 1 and Austin-Bergstrom International Airport (ABIA)