The 1031 Exchange

If you're in the real estate game, you've probably heard of the 1031 Exchange. It's a powerful tool that can save you a ton of money on capital gains taxes. But what exactly is it, and how does it work? Let’s dive into the nitty-gritty of this financial maneuver.

What is a 1031 Exchange?

Named after Section 1031 of the Internal Revenue Code, a 1031 Exchange allows you to defer capital gains taxes when you sell an investment property and reinvest the proceeds into a "like-kind" property. In simpler terms, it's like trading one property for another without having to pay Uncle Sam his cut—at least not right away.

§1031. Exchange of property held for productive use or investment (a) Nonrecognition of gain or loss from exchanges solely in kind.

(1) In general. –– No gain or loss shall be recognizedon the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held either for productive use in a trade or business or for investment.

The Deadlines: Time is of the Essence

Now, the IRS is not going let you take your sweet time with this. There are two critical deadlines you need to meet. The two critical time periods—the 45-day Identification Period and the 180-day Exchange Period— run concurrently, not separately.

Identification Period: You have 45 days from the sale of your relinquished property to identify up to three potential replacement properties. Miss this deadline, and you can kiss those tax savings goodbye.

Exchange Period: You've got 180 days from the sale to close on the new property. That's about six months, but don't dilly-dally; time flies when you're scrutinizing potential investments.

The Savings: Capital Gains Tax

Let's talk turkey—or in this case, money. When you sell an investment property, you're usually hit with capital gains tax on the profit. This can range from 15% to 20%, depending on your tax bracket. But with a 1031 Exchange, you defer this tax, allowing you to reinvest that money into your next property. It's a calculated move that can make your money work harder for you.

Deferred Taxes

Federal Capital Gains

State Capital Gains

Recapture of Depreciation

3.8% Net Investment Income Tax

The Savings: THE POWER OF THE DEFERRAL

Example:

Let's say you sell a property for $500,000 that you originally bought for $300,000. Normally, you'd owe capital gains tax on the $200,000 profit. But if you roll that into a new property through a 1031 Exchange, you defer paying those taxes. That's a savings of $30,000 to $40,000, depending on your tax bracket.

The Fine Print: Rules and Regulations

Like-Kind Property: The IRS is pretty lenient on what constitutes "like-kind," but generally, it means any real estate used for business or investment.

Same Taxpayer: The name on the title of the new property must be the same as the one on the relinquished property.

Debt Replacement: If your old property had a mortgage, the new one should have equal or greater debt to fully defer taxes.

A Tenacious Tool for the Savvy Investor

The 1031 Exchange is not for the faint of heart; it's a methodical, calculated move that requires a keen understanding of the real estate market and tax laws. But if you're up for the challenge, it can be a formidable tool in your investment arsenal.

So, there you have it, folks. The 1031 Exchange is a force of nature in the real estate world, and now you know how to harness its power. Until next time, keep those boots on the ground and your eyes on the prize!

Remember:

in real estate, as in life, fortune favors the bold and the well informed.

ADDITIONAL INFO

Keys for 1031 ExchANGE

Same Taxpayer Rule

Napkin Test (Purchase equal or greater)

Spend all cash on replacement property

Acquire debt equal or greater

Identify replacement in 45 days

Close in 180 days

Regulation of QIs; security of funds

List of Expenses that Qualify as Exchange Expenses : “Exchange Expenses" - when paid at closing with exchange funds, won't result in any tax liability.

Broker’s commissions

Exchange fees paid to a Qualified Intermediary

Title insurance fees for the owner’s policy

Escrow fees

Appraisal fees (required by contract)

Transfer taxes

Recording fees

Attorney’s fees incurred directly from the sale or purchase of the property

Key Considerations and Limitations:

Domestic vs. Foreign Property: Domestic and foreign real estate are not considered like-kind.

Improvements: Improvements conveyed without land do not qualify.

Access to Proceeds: Taxpayers cannot access sale proceeds directly; a Qualified Intermediary must facilitate the exchange.

Time Limits: Replacement property must be identified within 45 days of the sale and acquired within 180 days.

Personal Residences: Generally not eligible unless partially used for business.

Multiple Asset Categories: Non-like-kind assets (e.g., cash) are considered "boot" and trigger taxable events.

Related Party Sales: Scrutinized by the IRS and require justification beyond tax avoidance.

Incidental Personal Property: Allowed if its value doesn't exceed 15% of the replacement property's value.

Long-Term Tax Benefits and Strategies

Like-kind exchanges can amplify the impact of other tax benefits. For instance, repeated exchanges can significantly reduce the cost basis of a property, leading to substantial taxable gains upon sale. However, holding the property until death allows heirs to inherit with a stepped-up basis, effectively eliminating taxable gains for all parties involved.

Professional Guidance is Crucial - Commercial Broker and CPA

Due to the complexities and potential pitfalls of like-kind exchanges, it's imperative to consult with a qualified tax professional before proceeding. They can help ensure your exchange adheres to IRS regulations and maximizes your tax benefits. An experienced and well connected Commercial Real Estate Broker is ideal to find suitable properties according to your goals, keep you on Pace with the schedule and give you excellent advice and recommendations required to make quick decisions while reviewing a large amount of possible properties.

Another Option | Deferred Sales Trust (DST)

A Deferred Sales Trust is a legal agreement that allows you to sell assets like real estate or a business and defer the capital gains tax over a predetermined period. Essentially, you sell your asset to a trust, which then sells it to the final buyer. The trust holds the proceeds and pays you in installments, allowing you to spread out your capital gains tax liability over time.

How Does It Work?

Set Up the Trust: Before selling your asset, you'll work with tax and legal professionals to set up a DST.

Sell to the Trust: Instead of selling directly to a buyer, you sell your asset to the DST.

Trust Sells the Asset: The DST then sells the asset to the final buyer at the same sales price.

Installment Payments: The trust holds the sales proceeds and pays you in installments based on the terms you've agreed upon. These payments can include principal and potentially even earnings if the trust invests the funds.

Tax Deferral: You only pay capital gains tax on the installment payments as you receive them, effectively deferring your tax liability over the term of the trust.

Advantages of a DST

Flexibility: Unlike a 1031 Exchange, you're not restricted to "like-kind" investments. You can diversify your portfolio as you see fit.

Liquidity: Since the trust can sell the asset and hold cash or other investments, it can provide you with a more liquid position compared to directly holding real estate.

Estate Planning: A DST can be an effective tool for estate planning, allowing you to pass on wealth to heirs in a tax-efficient manner.

No Deadlines: Say goodbye to the stress of the 45-day and 180-day deadlines that come with a 1031 Exchange. A DST gives you more time to breathe and make calculated decisions.

Example: DST in Action

Let's say you sell a commercial property for $1 million with a capital gain of $400,000. Normally, you'd be looking at a hefty tax bill. But by using a DST, you can defer this tax by receiving installment payments over, say, 20 years. Plus, the trust can invest those funds, potentially earning you additional income over time. It's like having your cake and eating it too, but without the immediate tax indigestion.

Use Capital Gains to invest in Opportunity Zone

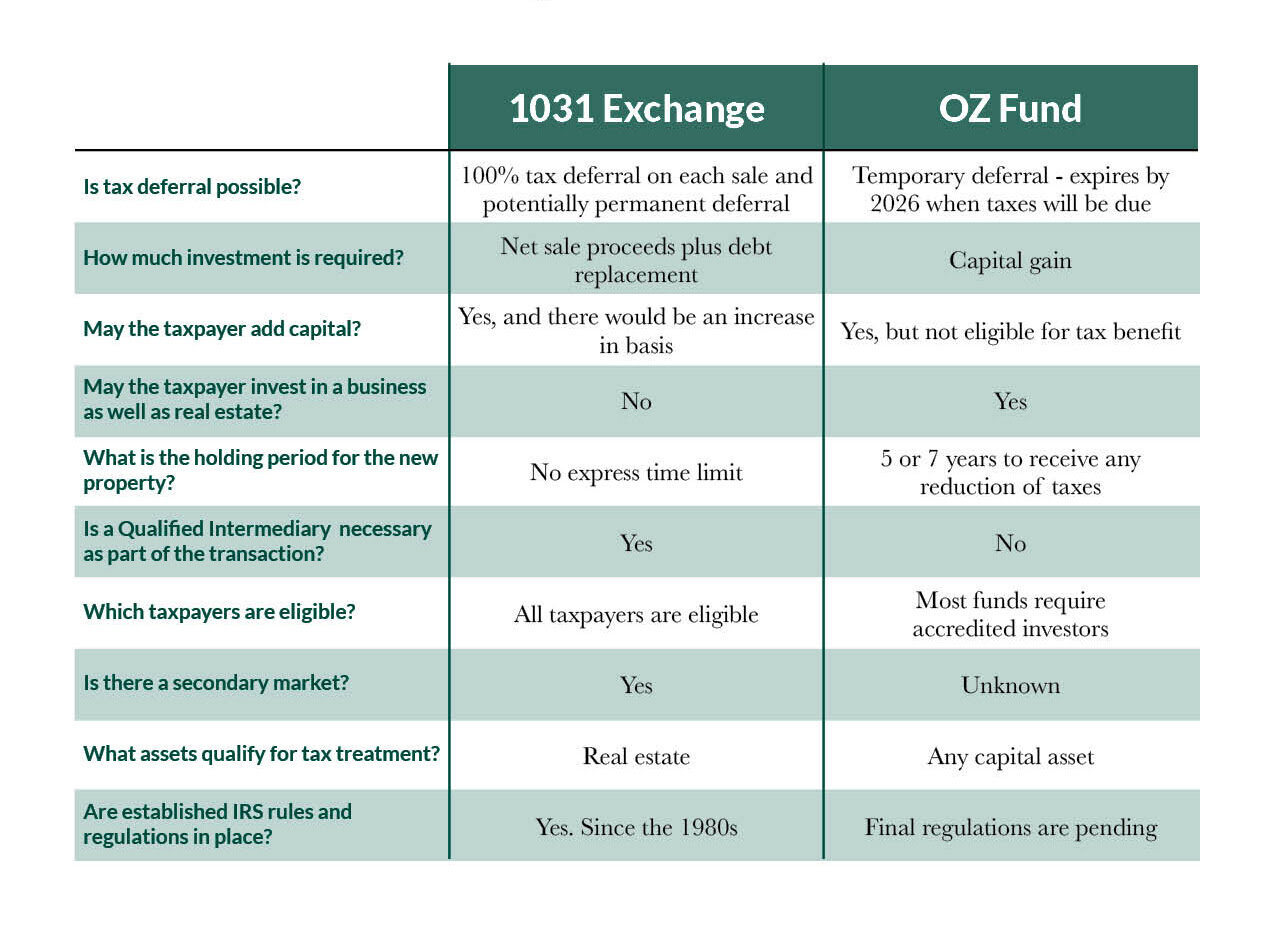

A Qualified Opportunity Fund (QOF) is a corporation or partnership in which taxpayers can “roll over” capital gains and obtain special tax benefits. ~ Jackson Walker Senior Council Attorney ran several “Test Projects” and found potential 30--40% increase in return

Who Benefits

Real Estate Investors: May obtain tax benefits only if “rolling over” capital gains, and especially if prepared to hold 10 years.

Real Estate Developers/Sponsors: May obtain a lower cost of capital (or charge a higher promote) in exchange for a promise to pursue QOF tax benefits for investors (but cannot obtain tax benefits directly for carried interest / promote).